Table of Contents

What is hundi business in english?

Hundi is a traditional, informal way of transferring money between countries. It works outside the formal banking system and relies on trust and a network of agents. Think of it as a verbal agreement that ensures the transfer of money. While hundi operates outside of official channels, it’s a well-established system with a long history, often used in areas where banking access is limited.

Hundi is similar to a money order, but instead of being issued by a financial institution, it’s handled by a hawala broker. These brokers act as intermediaries, connecting senders and recipients. The process usually involves the sender giving money to a hawala broker in one location, who then notifies their counterpart in the receiving location. The recipient can then collect the funds from the counterpart, minus a small fee.

It’s important to note that hundi systems are not regulated by any government or financial authority. While hundi can be a convenient way to transfer money, especially in regions with limited banking infrastructure, it also carries certain risks.

Here’s a deeper look at the key aspects of the hundi business:

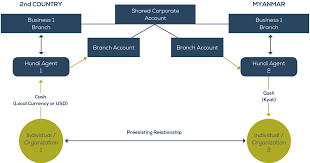

How it Works: The hundi system relies on a network of hawala brokers. When someone wants to send money, they approach a hawala broker, who is usually a trusted member of the community. The sender pays the money to the hawala broker, along with a small commission. The hawala broker then contacts their counterpart in the recipient’s location and instructs them to pay the money to the recipient.

Security: The security of hundi relies on the trust between the hawala brokers and their network. Since there’s no formal documentation or tracking, any discrepancies or disputes are usually settled through negotiations or informal mediation.

Legality: The legality of hundi varies from country to country. Some countries, like Bangladesh, consider hundi illegal because it operates outside the formal banking system and poses challenges in terms of tax collection and money laundering prevention. Other countries may have regulations or restrictions in place regarding hundi transactions.

Advantages:Hundi can be a convenient option for people who don’t have access to formal banking services or for those who need to transfer money quickly. It can be particularly useful for sending money to remote areas where banks are scarce.

Disadvantages: The informal nature of hundi means there’s no guarantee of security or transparency. There’s always a risk of fraud or theft, as well as a lack of accountability. Additionally, hundi can be used for illegal activities like money laundering.

In conclusion, hundi is a long-standing informal money transfer system that continues to play a role in certain communities. While it can be convenient, it’s crucial to understand the risks involved and to ensure that the hawala brokers you’re dealing with are trustworthy and reliable.

What is the purpose of a hundi?

Let’s break down these purposes in more detail:

Remittance: Imagine you’re a merchant in Delhi, and you need to send money to a business partner in Mumbai. In the absence of modern banking systems, a hundi provided a safe and reliable way to do this. You would go to a hundi writer, who would issue a document with your name, the amount to be paid, and the recipient’s name. This hundi would be carried by a trusted traveler or messenger to Mumbai, where the recipient could present it to a designated agent or banker to receive the funds.

Credit: Hundis also served as a form of credit instrument. If a merchant needed to borrow money for a business venture, they could go to a hundi writer and get a loan in the form of a hundi. The hundi would detail the loan amount, the repayment terms, and the interest rate. This was a convenient way to access credit, especially in a time when formal banking institutions were less common.

Bill of Exchange: Hundis also functioned as bills of exchange in trade transactions. If you were buying goods from a merchant in another city, you could issue a hundi to pay for the goods at a later date. This allowed you to secure the goods without having to carry large sums of cash, and it also provided a level of security as the hundi could be negotiated only by the designated payee.

Hundis played a crucial role in the Indian economy for centuries. They provided a flexible and efficient way to manage transactions, especially in the absence of a modern banking system. These versatile instruments helped facilitate trade, finance, and personal transactions across the country.

Is hundi illegal?

Let’s break down why hundi transactions are illegal in a lot of places:

Money Laundering: Hundi is often used to move large sums of money without going through traditional banking channels. This makes it easier to hide the origin of the funds, which is a key characteristic of money laundering.

Tax Evasion: Because hundi transactions are not recorded, individuals can avoid paying taxes on the money they transfer. This can result in significant losses for governments.

Lack of Oversight: Since hundi operates outside the legal financial system, there is no official oversight to ensure that the transactions are legitimate. This creates a breeding ground for fraud and abuse.

Risk of Sanctions: If you are caught using hundi, you could face fines and other penalties. This is because the practice is illegal in many countries and authorities are actively working to crack down on it.

It’s essential to be aware of the risks associated with hundi and to choose legal and regulated methods for sending and receiving money.

What is hundi with example?

Imagine you’re a merchant in Delhi wanting to buy spices from a trader in Gujarat. Instead of carrying a large sum of cash, you could issue a hundi to the trader. The hundi would be a document stating that a certain amount of money would be paid to the trader by your trusted agent in Gujarat. This way, you wouldn’t have to worry about carrying cash across long distances, and the trader could be confident they would receive payment.

Hundis were popular for a few reasons. They were safer than carrying large amounts of cash, which could be lost or stolen. They were also a convenient way to transfer money across long distances, especially in a time when banking systems weren’t well-developed. There were different types of hundis like “Darshani Hundi” where payment was made on sight, “Adhati Hundi” where payment was made after a certain period, “Nam Hundi” payable to a specific person, and “Hundi-Mushtarka” payable to multiple people.

Hundis were a crucial part of the Indian economy for centuries. They provided a secure and efficient way to carry out financial transactions, helping to facilitate trade and commerce across the vast Indian subcontinent. Although hundis are no longer used in modern India, their historical significance remains, as they were a vital precursor to modern banking systems.

What is the way of hundi?

The hundi system involves two main players: the drawer, who creates the hundi, and the payee, who ultimately receives the payment. Think of it like a promissory note. You can even transfer it to someone else by endorsing it!

Here’s how it works:

Imagine you’re a merchant in India needing to send money to a relative in another city. Instead of risking a long and potentially unsafe journey with cash, you could use a hundi. You’d visit a trusted hundi broker, who would issue you a document called a hundi. This hundi would essentially be a promissory note, guaranteeing payment to your relative when they present it to a designated broker in their city.

The hundi system relies on a network of brokers who trust each other. This trust allows money to be transferred efficiently across vast distances without the need for physical cash or complex banking systems. The hundi system also offers a convenient way to transfer money, especially in areas where access to banks is limited.

Of course, like any financial system, hundi transactions involve some risks. The system’s success depends on the honesty and reliability of the brokers involved. However, in areas with limited banking infrastructure, the hundi system can be a valuable tool for financial transactions.

What are the advantages of hundi?

Hundi is also a popular method for cross-border trade and remittances. This is because it can be used to transfer money between countries without going through the formal banking system. This can be particularly helpful in situations where there are restrictions on international money transfers, or where people are sending money to countries with less-developed banking systems.

One of the key advantages of hundi is its speed and ease of use. Unlike traditional bank transfers, which can take several days to process, hundi transfers can be completed in a matter of hours. This makes it a convenient option for people who need to send money quickly, such as for emergencies or time-sensitive transactions.

Another advantage of hundi is its flexibility. Hundi transactions can be conducted in various currencies, and the amounts can be adjusted to suit the needs of the sender and receiver. This makes it a versatile option for people who need to transfer money for a variety of purposes.

Hundi is a traditional financial system that has been around for centuries. It continues to play an important role in many parts of the world, particularly in regions where access to banking services is limited. Its key advantages include speed, ease of use, flexibility, and confidentiality. These factors make hundi a valuable tool for individuals, businesses, and communities, especially in situations where traditional banking services are not readily available.

What is the meaning of hundi offering?

Here’s a revised version:

What is a Hundi Offering?

A hundi is like a donation box found in Indian temples. Devotees offer cash to their chosen deity by dropping it into the hundi. It’s a way for people to express their faith and gratitude, and the money collected is often used to support the temple and its activities.

Now, you might be wondering why the hundi became a topic of discussion during the 2016 demonetization in India. It was because the government removed the Rs 500 and Rs 1,000 notes from circulation. Some people were concerned that these discontinued notes might have been hidden in hundis, where there isn’t as much oversight as in banks. This was because the hundis are often managed by temple staff who may not be able to track the origin of every donation.

Think of the hundi as a traditional, spiritual way of giving. It’s a beautiful practice that connects people to their faith and supports the temple community.

See more here: What Is The Purpose Of A Hundi? | What Is Hundi In Business Studies

What is Hundi in business?

Think of Hundi as a pre-arranged financial transaction. A person (the remitter) in one place gives money to a Hundi broker, who then issues a document (the Hundi). This Hundi is then sent to another person (the payee) in a different location, who can then redeem the money from a different broker in their area. The brokers act as agents and rely on networks of trust and long-standing relationships to facilitate these transactions.

Now, the term Hundi is thought to be derived from the Hindi word “hund”, which means “dog.” While the origin might be curious, it’s important to understand how Hundi works in practice. Think of it as a way for people in remote areas or those who might not have access to traditional banking services to securely transfer money to family, friends, or businesses.

What is a Hundi in banking?

A hundi is like an ancient financial tool used in India, dating back to medieval times. Think of it as a way to move money around, borrow money, or even settle trade deals. It was a versatile instrument!

How Did It Work?

Imagine a system where you could send money to a relative in a distant village without having to physically carry the cash. The hundi made this possible. The person sending the money would go to a hundi issuer (a trusted individual or merchant) and pay a fee. The issuer would then issue a written document, the hundi, to the sender. This document would be sent to the recipient’s village, where they could present it to another hundi issuer and receive their funds, minus the fees. It was like a secure way to transfer money before the modern banking system!

Hundi as a Credit Instrument

The hundi was also a kind of loan. If you needed a loan, you could approach a hundi issuer and get a hundi document, which essentially acted as an IOU. The hundi issuer would loan you money, and you would repay the loan with interest later.

Hundi in Trade Transactions

In the world of trade, the hundi acted as a bill of exchange. If a merchant wanted to buy goods from another merchant in a different city, they could issue a hundi to the seller. The hundi guaranteed payment upon delivery of the goods. It was a safe and reliable way to ensure both parties got what they were owed.

The Enduring Legacy of the Hundi

Although the hundi isn’t as common today as it was centuries ago, it’s an important part of financial history. It shows how people found creative ways to manage money long before modern banking practices became widespread. It was a system built on trust, a bit like a financial chain letter, where everyone involved had to be honest and reliable for the system to function. The hundi is a fascinating example of how financial tools have evolved over time to meet the needs of people and economies.

What are hundis?

Think of it like a letter of credit. The person issuing the hundi would write it in a local language and it would be presented to the payee. The payee would then take the hundi to a designated person (the drawee) who would then pay the amount specified on the hundi. It was a way to transfer money safely and securely across long distances in a time before modern banking.

This system was especially useful for traders and merchants who needed to move money between different cities or regions. The hundi acted as a guarantee of payment and provided a level of trust between the parties involved. Imagine, if you were a merchant in Delhi and you needed to buy goods from a merchant in Mumbai, you could send a hundi to the Mumbai merchant. They could then take it to a trusted bank or money lender in Mumbai and get paid for the goods.

While hundis are not as widely used today as they once were, they are still considered a valuable part of India’s financial heritage. They demonstrate how people in India have always been innovative and resourceful when it comes to dealing with financial transactions.

What is Hundi system?

So, what exactly is the hundi system? It’s essentially a form of informal money transfer that relies on a network of trusted individuals called hawaladars. These individuals act as intermediaries, facilitating the transfer of funds without the need for banks or other financial institutions. Think of it as a chain of trust, where each hawaladar relies on the honesty and integrity of the others in the network.

Here’s how it works: A person wanting to send money to someone in another location would approach a hawaladar and provide them with the details of the recipient. They would then pay the hawaladar the amount to be transferred, along with a small commission. The hawaladar would then contact another hawaladar in the recipient’s location and inform them of the transaction. The recipient would then be able to collect the money from the second hawaladar.

The hundi system has existed for centuries, dating back to ancient times in India and the Middle East. It was particularly popular in regions where formal banking systems were underdeveloped or unavailable. The system’s reliance on trust and personal relationships made it an attractive alternative to traditional banking, especially for individuals who wanted to send money to family and friends in remote locations or who were concerned about the security of their funds. While the hundi system has faced criticism for its potential use in illegal activities, it remains a significant part of informal financial networks in many parts of the world, particularly in developing countries.

See more new information: musicbykatie.com

What Is Hundi In Business Studies: A Traditional Financial Instrument

Okay, so you’re probably thinking, “What in the world is a hundi?” It sounds kind of exotic, right? Well, it is, but it’s also a pretty important concept in business studies, especially when we’re talking about financial systems and how money moves around the world.

Think of it like this: Hundi is a traditional form of money transfer that’s been used for centuries, particularly in South Asia and parts of the Middle East. It’s kind of like a pre-dated check, but with a lot more history and cultural significance.

Here’s the basic idea:

* Someone wants to send money to someone else, maybe a family member or a business partner.

* They go to a hundioperator (like a money changer or a banker).

* The hundioperator issues a hundi, which is essentially a document promising to pay a certain amount of money to the recipient.

* The hundi is then sent to the recipient, who can then exchange it for cash with another hundioperator in their location.

It’s all about trust!

You see, hundi systems rely heavily on trust and reputation. The hundioperator has to be trustworthy to ensure that the recipient can actually cash out the hundi. It’s a system that’s been built on community ties and relationships for a long time.

So, how does it work in practice?

Let’s imagine you’re in India and you want to send some money to your brother in the UK. You might go to a local hundioperator, give them the money you want to send, and they’ll write out a hundi in your brother’s name.

Now, this hundi might look like a simple piece of paper, but it actually contains some important details:

The amount of money being transferred.

The name of the recipient.

The name of the hundioperator who issued it.

The name of the hundioperator who will be responsible for cashing it out.

This hundi gets sent to your brother in the UK. He can then take it to a hundioperator there, who’ll verify it and give him the cash equivalent.

A little bit about its history.

Hundi systems have been around for centuries. They were particularly common during the days of the British Empire, when people needed to send money back and forth across vast distances.

You know, before we had things like Western Union and online banking, hundi was a vital way for people to manage their finances.

The rise of modern financial systems.

Of course, with the growth of modern financial systems, the use of hundi has declined in some areas. But it’s still important in some parts of the world, especially in places where access to formal banking services is limited.

And, it’s a fascinating historical example of how people have always found ways to manage their money, even without access to modern technology.

Some of the advantages of using a hundi system.

Simplicity: They’re pretty straightforward to use. No fancy paperwork or complex procedures.

Trust: As we’ve already mentioned, hundi systems rely on trust and reputation, which can be a big advantage in communities where those things are important.

Accessibility:Hundi systems can be more accessible than formal banking services, especially in remote areas.

But, there are some disadvantages too.

Security: Because hundi relies on trust, it can be vulnerable to fraud and theft.

Lack of transparency:Hundi systems can be opaque, making it difficult to track the flow of money.

Potential for money laundering: Unfortunately, hundi systems have been used in the past for money laundering activities.

The future of the hundi system.

In the future, hundi systems are likely to continue to play a role in some parts of the world. They’re still important for communities that don’t have access to modern financial services.

However, as more people gain access to formal banking and financial services, the use of hundi is likely to decline.

Okay, let’s get down to some FAQs.

Frequently Asked Questions about Hundi:

What is a hundi used for?

Hundi was traditionally used for transferring money, especially for remittances, payments between businesses, and even paying for goods and services.

What are the benefits of using a hundi?

Hundi offered a way for people to transfer money when formal banking systems weren’t readily available.

Hundi could be particularly useful for transferring money across borders or to remote areas.

What are the risks associated with hundi?

Hundi carries risks, including fraud, theft, and potential use in illegal activities like money laundering.

Is hundi legal?

Hundi itself isn’t necessarily illegal. However, the way it’s used could lead to legal issues if it’s used for illegal activities like money laundering.

Is hundi still used today?

Hundi is still used in some parts of the world, particularly in communities with limited access to banking. But, its use has decreased in recent years due to the growth of formal banking systems.

How can I learn more about hundi?

* You can find information about hundi online, in libraries, or through academic journals.

How does the hundi system differ from modern banking systems?

Hundi relies on trust and reputation, while modern banking systems rely on financial institutions and technology.

Hundi often involves physical documents, while modern banking systems use electronic transfers.

Does hundi have any connection to modern financial instruments?

Hundi has some similarities to modern financial instruments like bills of exchange and letters of credit, which are also used for transferring money.

Is hundi a viable option for businesses today?

Hundi might not be the most secure or transparent option for businesses today. Modern banking systems offer greater security and transparency.

So, there you have it! Hundi is a fascinating glimpse into the history of finance, and it’s a reminder that people have always found innovative ways to manage their money, even before the age of online banking and digital wallets.

What Is Hundi In Business Studies Class 11

Hundi is a financial term in business studies class 11. It is a derivative of the Hindi word “hund”, meaning “dog”. Hundi is used to describe a financial instrument, 121 Business Ideas

What are Hundis? What are its types? – Accountlearning

An age-old tradition of business transactions, peculiar to India, Hundis are negotiable instruments written in various vernacular local languages in the country. The Accountlearning

Negotiable Instruments Act Hundi – Meaning, Types and FAQs

Hundi means an aspect of the causal framework with no lawful status and is not secured under the Negotiable Instruments Act, 1881. Although all types of hundi Vedantu

Hundi System: Meaning, Types, Advantages, Importance And More!

Overview. Test Series. The hundi system, also known as the hawala system, is an old method of transferring money that has been used for a long time in different Testbook

(PDF) Hundi System in Medieval India: Perspectives

Hundis in Medieval India were financial instruments that were used for remittance across distant places. In this paper, I compile the narratives provided by South Asian historians about the hundi system and re Academia.edu

What is a Hundi? | Business Studies Questions – Toppr

Solution. Verified by Toppr. Hundi is an instrument of exchange, which was prominent in the subcontinent in ancient times. It involves a contract which:- warrants the payment of Toppr

Concept Of Hundi – Business Studies Xi

What Is Hundi ? | By Praveen Mishra | Lukmaan Ias

हुण्डी भनेको के हो ? || Why Is Hundi Illegal || Economic Outlook

#4, Class 11 Business Studies Chapter 1 || History Of Trade And Commerce || Types Of Hundi

Types Of Hundi Class 11Th Business Studies Types Of Hundi What Is Hundi Classification Of Hundi

Hundi And Types Of Hundi

What Is Hundi , 11 Class , +1 Class Business Studies, Easy Way

Tại Sao Đáng Học!? Review Đánh Giá Chi Tiết Sách Hackers Ielts Writing

Link to this article: what is hundi in business studies.

See more articles in the same category here: https://musicbykatie.com/wiki-how/