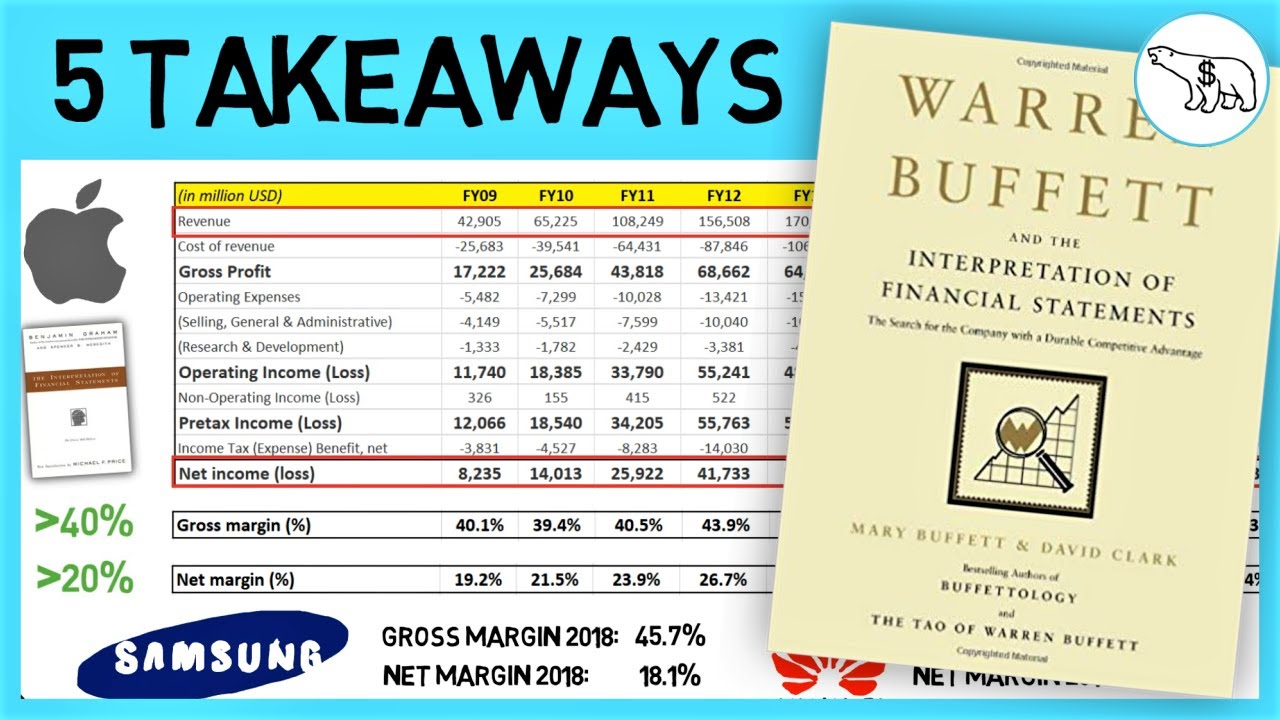

여기에서 Warren Buffett 및 Mary Buffett와 David Clark의 재무제표 해석을 받아 채널을 지원하세요. Amazon Associate로서 저는 적격 구매로 수익을 얻습니다. 워렌 버핏은 세계에서 가장 부유한 사람 중 한 명입니다. 그의 억만장자 성공의 핵심 요소 중 하나는 지속 가능한 경쟁 우위를 가진 회사를 매수하는 능력이었습니다. Coca-Cola, Moody’s 또는 See’s Candy를 생각해 보십시오. 이 비디오에서는 이러한 지속 가능한 경쟁 우위를 가진 회사를 식별하는 방법을 학습하여 돈 버는 방법에 대한 그의 성공을 모방할 수 있는지 확인할 것입니다. 보다 구체적으로, 우리는 손익 계산서, 대차 대조표 및 현금 흐름표와 같은 주식 시장 회사의 재무 제표를 분석하여 이를 수행하는 방법을 배울 것입니다. 이것은 Mary Buffett과 David Clark이 작성한 “Warren Buffett과 재무 제표의 해석”에 대한 상위 5개 테이크 아웃 비디오입니다. 주식 시장 회계를 마스터하는 방법에 대한 재생 목록: Warren Buffett의 상위 5가지 요약 및 재무제표 해석: 01:25 1. 일관성은 왕입니다 03:32 2. Warren Buffett이 손익계산서에서 찾고 있는 것 05:40 3. Warren Buffett이 대차 대조표에서 찾고 있는 것 08:00 4. Warren Buffett이 현금 흐름표에서 찾고 있는 것 09:50 5. 매각 시기 TL;DW: – 지속적인 경쟁 우위를 가진 비즈니스를 찾고 있을 때 , 키워드는 일관성입니다. – 손익계산서에서 지속적으로 경쟁업체를 능가하는 지속적으로 증가하는 순이익 및 이익 마진을 찾으십시오. – 대차 대조표를 관찰할 때 우수한 비즈니스는 자본 수익률이 높으며 거의 많이 필요하지 않음을 기억하십시오. 부채가 많고 이익 잉여금이 일반적으로 꾸준한 성장을 보여줍니다. – 현금 흐름표에서 자본 지출을 검토하여 기업이 주주를 위해 돈을 벌고 있는지 확인하려고 합니다. – 심지어 환상적인 기업일지라도 다른 곳에서 돈이 필요하거나 경쟁 우위가 위태로운 경우 또는 가격표가 미친 수준에 있는 경우 판매해야 합니다. 이 채널의 목표는 귀하가 더 많은 돈을 벌고 개인 재정을 개선하는 데 도움이 되는 것입니다. 백만장자가 되는 방법? 거기에 도달하는 방법에는 여러 가지가 있습니다. 주식 시장에 투자하거나, 주식 거래자가 되거나, 부동산 투자를 하거나, 기업가가 되지 않는 이유는 무엇입니까? 그러나 주식에 투자하는 방법이나 임대 부동산으로 수동 소득을 창출하는 투자 전략에 관심이 있든 상관없이 여기에서 솔루션(또는 최소한 아이디어)을 제공할 수 있기를 바랍니다. 우리 시대의 가장 위대한 투자자인 워렌 버핏은 경쟁적인 아이디어로 마음을 가득 채운 다음 자신에게 맞는 것이 무엇인지 확인해야 한다고 말합니다. 이 채널은 이러한 아이디어로 마음을 채우는 것입니다. 그리고 그 과정에서 돈 버는 도구 상자를 업그레이드합니다. .

Table of Contents

Images related to the topic financial analysis of a company

WARREN BUFFETT AND THE INTERPRETATION OF FINANCIAL STATEMENTS

Search related to the topic WARREN BUFFETT AND THE INTERPRETATION OF FINANCIAL STATEMENTS

#WARREN #BUFFETT #INTERPRETATION #FINANCIAL #STATEMENTS

WARREN BUFFETT AND THE INTERPRETATION OF FINANCIAL STATEMENTS

financial analysis of a company

온라인으로 돈을 버는 모든 최신 방법 보기: 여기에서 더 보기

온라인으로 돈을 버는 모든 최신 방법 보기: 여기에서 더 보기