Are you looking for an answer to the topic “Does Roth IRA reduce AGI?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

Roth IRA contributions will never reduce your adjusted gross income because the contributions are made with after-tax dollars.Traditional IRA contributions are made with pre-tax dollars. Therefore, they do reduce your AGI. However, you will pay taxes when you withdraw the funds at retirement. Roth IRA contributions are not tax-deductible, and therefore do not reduce your AGI.If you had capital gains during the year (such as gain from a sale of stock or investment property), then you can offset those gains with capital losses. You can also claim a net capital loss deduction of up to $3,000 against the rest of your income and get a lower AGI.

Table of Contents

Does Roth IRA affect AGI?

Traditional IRA contributions are made with pre-tax dollars. Therefore, they do reduce your AGI. However, you will pay taxes when you withdraw the funds at retirement. Roth IRA contributions are not tax-deductible, and therefore do not reduce your AGI.

What reduces your adjusted gross income?

If you had capital gains during the year (such as gain from a sale of stock or investment property), then you can offset those gains with capital losses. You can also claim a net capital loss deduction of up to $3,000 against the rest of your income and get a lower AGI.

What Happens If You Hit the Roth IRA Income Limit?

Images related to the topicWhat Happens If You Hit the Roth IRA Income Limit?

Do Roth 401k contributions lower your AGI?

Roth 401(k) contributions don’t reduce either AGI or MAGI, as they are made with after-tax dollars.

Does making an IRA contribution reduce AGI?

Key Takeaways. Contributions to a traditional IRA can reduce your adjusted gross income (AGI) for that year by a dollar-for-dollar amount. If you have a traditional IRA, your income and any workplace retirement plan you own may limit the amount by which your AGI can be reduced.

How much will a Roth IRA reduce my taxes?

The Saver’s Tax Credit

Using IRS Form 8880, you can receive a credit of up to 50% on your first $2,000 in Roth IRA contributions, if you’re single and your income falls within the income limits. The credit applies to a contribution amount of $4,000 if you’re married, filing jointly.

How does Roth IRA affect tax return?

Contributions to a Roth IRA aren’t deductible (and you don’t report the contributions on your tax return), but qualified distributions or distributions that are a return of contributions aren’t subject to tax.

How much will an IRA reduce my taxes 2021?

Traditional IRA contributions can save you a decent amount of money on your taxes. If you’re in the 32% income tax bracket, for instance, a $6,000 contribution to an IRA would equal about $1,000 off your tax bill. You have until tax day this year to make IRA contributions that reduce your taxable income from last year.

See some more details on the topic Does Roth IRA reduce AGI? here:

How IRA Contributions Can Reduce Adjusted Gross Income …

A Roth IRA is funded with post-tax dollars. Therefore, it does not reduce your AGI. Investments grow tax free and there are no taxes on …

Last-Minute IRA Contributions Might Lower Your Taxes – Forbes

But if they contribute $4,000 to an IRA, they could not only lower their potential income tax liability by $480, but they’d also lower their AGI …

Does IRA reduce taxable income?

In the eyes of the IRS, your contribution to a traditional IRA reduces your taxable income by that amount and, thus, reduces the amount you owe in taxes.

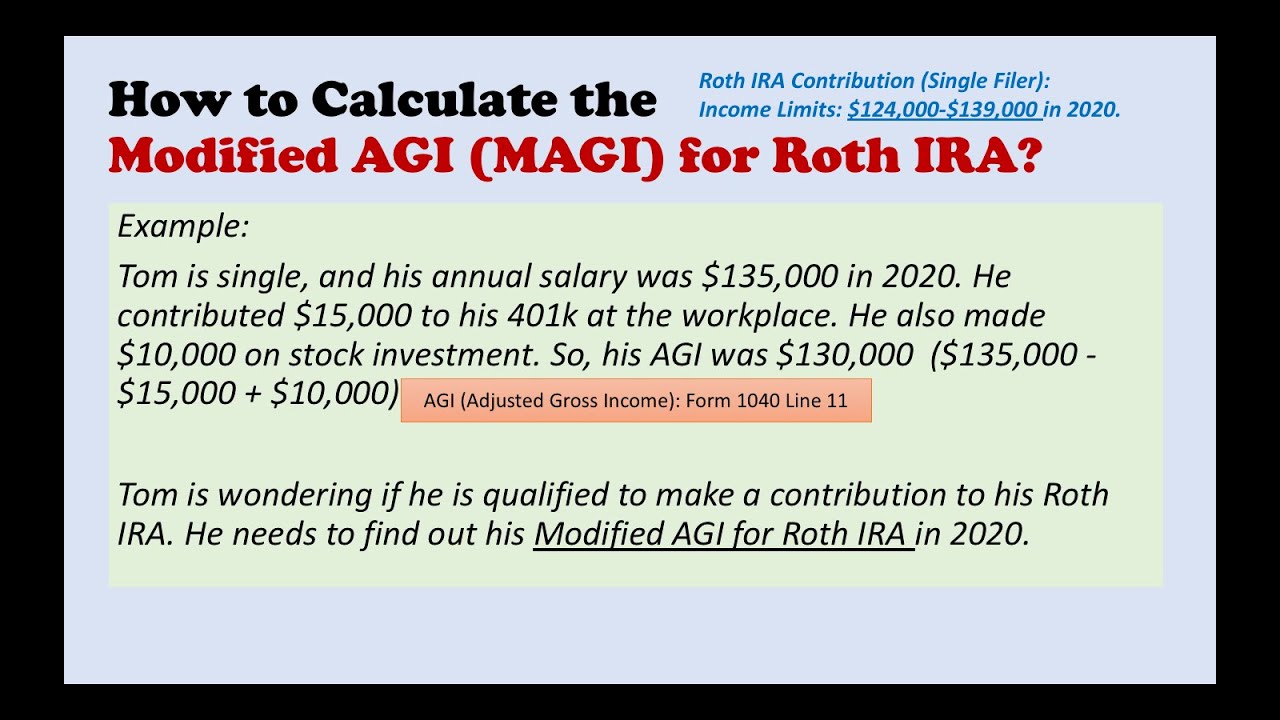

How to Calculate the Modified AGI (MAGI) for Roth IRA?

Images related to the topicHow to Calculate the Modified AGI (MAGI) for Roth IRA?

How can I reduce my taxable income after the end of the year?

- Contribute to retirement accounts. …

- Make a last-minute estimated tax payment. …

- Organize your records for tax time. …

- Find the right tax forms. …

- Itemize your tax deductions.

How do I reduce my modified adjusted gross income?

Reduce your MAGI with a retirement plan, HSA contributions, and self-employed health insurance premiums. You can reduce your MAGI by earning less money, but a lot of people prefer to look for deductions instead.

What’s modified adjusted gross income?

Modified Adjusted Gross Income (MAGI) in the simplest terms is your Adjusted Gross Income (AGI) plus a few items — like exempt or excluded income and certain deductions. The IRS uses your MAGI to determine your eligibility for certain deductions, credits and retirement plans. MAGI can vary depending on the tax benefit.

Does standard deduction reduce AGI?

AGI is used to calculate your taxes in two ways:

It’s the starting point for calculating your taxable income—that is, the income you pay taxes on. To get taxable income, take your AGI and subtract either the standard deduction or itemized deductions and the qualified business income deduction, if applicable.

Does opening a Roth IRA help with taxes?

With a Roth IRA, contributions are made on an after-tax basis. That means you won’t be able to write off anything you save. The trade-off is that when it’s time to take the money out, you won’t owe any additional tax.

How much will contributing to an IRA reduce my taxes?

Contribute to an IRA. You can defer paying income tax on up to $6,000 that you deposit in an individual retirement account. A worker in the 24% tax bracket who maxes out this account will reduce his federal income tax bill by $1,440. Income tax won’t apply until the money is withdrawn from the account.

When to report Roth contributions on tax return?

Images related to the topicWhen to report Roth contributions on tax return?

How can I reduce my taxable income 2021?

- Defer bonuses. …

- Accelerate deductions and defer income. …

- Donate to charity. …

- Maximize your retirement. …

- Spend your FSA. …

- Buy high, sell low. …

- Make adjustments in W-4 withholding. …

- Be aware of the ‘other dependent credit’

What is a backdoor Roth IRA?

A backdoor Roth IRA is not an official type of individual retirement account. Instead, it is an informal name for a complicated method used by high-income taxpayers to create a permanently tax-free Roth IRA, even if their incomes exceed the limits that the tax law prescribes for regular Roth ownership.

Related searches to Does Roth IRA reduce AGI?

- does roth ira reduce agi

- does 401k reduce agi

- how to reduce agi

- roth ira calculator

- how much will an ira reduce my taxes

- does a roth ira contribution reduce your agi

- does roth ira affect agi

- does contributing to roth ira reduce agi

- roth ira income limits

- do roth ira distributions affect agi

- does an ira reduce agi

- backdoor roth ira

- traditional ira vs roth ira

- can ira reduce agi

- does roth ira reduce taxable income

Information related to the topic Does Roth IRA reduce AGI?

Here are the search results of the thread Does Roth IRA reduce AGI? from Bing. You can read more if you want.

You have just come across an article on the topic Does Roth IRA reduce AGI?. If you found this article useful, please share it. Thank you very much.