Are you looking for an answer to the topic “Does ADP automatically send out W-2?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

You will need to contact your former company HR or Payroll department to request a copy of your W-2. ADP cannot provide you with your W-2.Printed Copies: Your employer should provide your Form W-2 and 1099 by January 31. Read more in our Form W-2 and 1099 Guide for Employees. Online Access: If your current employer has given you online access to view your pay information, you can log into login.adp.com to view your W-2 online.If you are an employee of a company and will receive a W-2 for your income taxes, it will be sent to you automatically each year by your employer. Your employer will also submit a copy of your W-2 with the IRS.

Table of Contents

When can I get my W-2 from ADP?

Printed Copies: Your employer should provide your Form W-2 and 1099 by January 31. Read more in our Form W-2 and 1099 Guide for Employees. Online Access: If your current employer has given you online access to view your pay information, you can log into login.adp.com to view your W-2 online.

Do you automatically get a W-2?

If you are an employee of a company and will receive a W-2 for your income taxes, it will be sent to you automatically each year by your employer. Your employer will also submit a copy of your W-2 with the IRS.

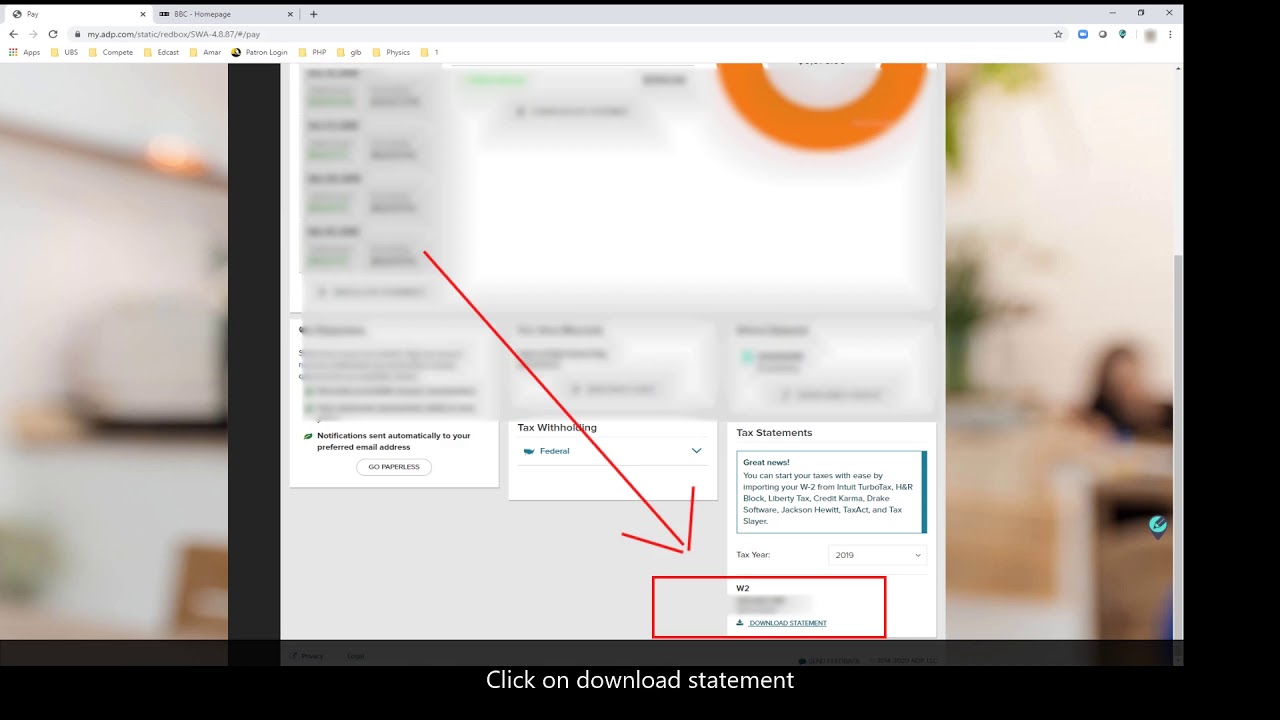

How do I get my W-2 from ADP?

Images related to the topicHow do I get my W-2 from ADP?

Can I file my taxes without my W-2?

If you cannot get a copy of your W-2 or 1099, you can still file taxes by filling out Form 4852, “Substitute for Form W-2, Wage and Tax Statement.” This form requests information about your wages and taxes that were withheld. It may be helpful to have documentation, such as a final pay stub, available to complete it.

How can I get a copy of W-2 quickly?

The quickest way to obtain a copy of your current year Form W-2 is through your employer. Your employer first submits Form W-2 to SSA; after SSA processes it, they transmit the federal tax information to the IRS.

Do you have to file a W-2 If you made less than $1000?

The short answer is, “It depends.” If you worked a regular job, received a W-2 and that was the amount you earned for the entire year, then you most likely won’t have to file since your standard deduction would be greater than your actual tax burden. If the income was from a Form 1099, you should consider filing.

Will you get a W-2 if you make less than 600?

Workers who receive a W-2 from a company with less than $600 in wages are still responsible for reporting it as there is no W-2 minimum amount to file. Description:The employer is required to send you a copy – Part B and C of the W-2 – either by mail or electronically by January 31 of the subsequent tax year.

What if I didn’t get a W-2 from my employer?

If you’re unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.

See some more details on the topic Does ADP automatically send out W-2? here:

How does ADP work with getting your W2? My employer is …

ADP handles a great deal of the payroll in the US. Depending on the level of service chosen and the size of your employer …

How to Get Your W-2 From ADP | Sapling

On your employer’s end, the deadline is January 31 to deliver the forms to qualifying employees and contractors. This is done by mail or hand delivery. After …

W-2 Forms and Other Tax Forms | MIT VPF

If you have opted to receive your printed W-2 Form through the mail, you will receive it from ADP Payroll Services. Watch for your W-2 Form in your USPS mail in …

ADP Run Review 2022 – Forbes Advisor

ADP automatically files and pays payroll taxes for you and employees. For an additional fee, it’ll also file W-2s and deliver copies to …

Find Your W2 on ADP! – Atlas Daily 421

Images related to the topicFind Your W2 on ADP! – Atlas Daily 421

Can I do taxes with last pay stub?

No, you cannot file a return using your last pay stub. Your last paycheck stub is not guaranteed to be an accurate statement of your annual earnings, and it could be missing some information that you need to file a full tax return.

Will I get audited if I forgot W-2?

It may be. Sometimes the IRS will catch your missing W-2 and send you a letter letting you know about the missing information and they will correct it for you or if you have other issues on your return they may reject it. So, in the meantime, you will need to wait to see if it is processed or not.

Can I sue my employer for not giving me my W-2?

No, you can’t sue the former employer for not sending you a W2, especially considering your employer has until January 31st.

How can I get my W-2 form 2020 online?

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS’ Online Ordering for Information Returns and Employer Returns page, or visit www.irs.gov/orderforms and click on Employer and Information returns.

Will I get a tax refund if I made less than $10000?

If you earn less than $10,000 per year, you don’t have to file a tax return. However, you won’t receive an Earned-Income Tax Credit refund unless you do file.

How to download your W2 pdf from ADP Web Site #ADP #W2 #TAX

Images related to the topicHow to download your W2 pdf from ADP Web Site #ADP #W2 #TAX

Do I need to file taxes if I only made $300?

Do I have to claim if I made less than $300 dollars, 19 and considered dependent? You are not required to file a tax return for earnings of less than $300. If any taxes were withheld (doubtful) then you could file for a refund. You would not get back anything withheld for Social Security or Medicare.

What is the minimum income to file taxes in 2020?

Minimum income to file taxes

Single filing status: $12,550 if under age 65. $14,250 if age 65 or older.

Related searches to Does ADP automatically send out W-2?

- how can i get a copy of my w2 online

- does adp automatically send out w2

- does adp show w2

- can adp give me my w2

- adp w2 former employee

- can i get my w2 online from adp

- when does adp upload w2

- w2 adp login

- adp login

- adp customer service

- adp w2 customer service

- does adp send out w2

- amazon adp

- how long does adp keep w2

Information related to the topic Does ADP automatically send out W-2?

Here are the search results of the thread Does ADP automatically send out W-2? from Bing. You can read more if you want.

You have just come across an article on the topic Does ADP automatically send out W-2?. If you found this article useful, please share it. Thank you very much.