Are you looking for an answer to the topic “Do banks prosecute check kiting?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

In the United States, check kites are prosecuted under Title 18, U.S. Code Section 1344, which is defined as obtaining the funds of a federal bank under false pretenses. In effect, a check kite is obtaining an interest-free loan from a bank without the bank’s knowledge.The American Bankers Association describes check-kiting as “the process of floating worthless checks between accounts established in two or more banks.” ABA goes on to state “a kiter is able to create the impression of having a real balance in each of the banks by carefully timing deposits and checks, and taking …Legal Penalties

Kiting is a serious crime and is one of the most enforced types of white collar crimes. First-time offenders can face very stiff penalties, including fines of $500,000 or more as well as more than 20 years in prison.

Table of Contents

Who investigates check kiting?

The American Bankers Association describes check-kiting as “the process of floating worthless checks between accounts established in two or more banks.” ABA goes on to state “a kiter is able to create the impression of having a real balance in each of the banks by carefully timing deposits and checks, and taking …

What is the charge for check kiting?

Legal Penalties

Kiting is a serious crime and is one of the most enforced types of white collar crimes. First-time offenders can face very stiff penalties, including fines of $500,000 or more as well as more than 20 years in prison.

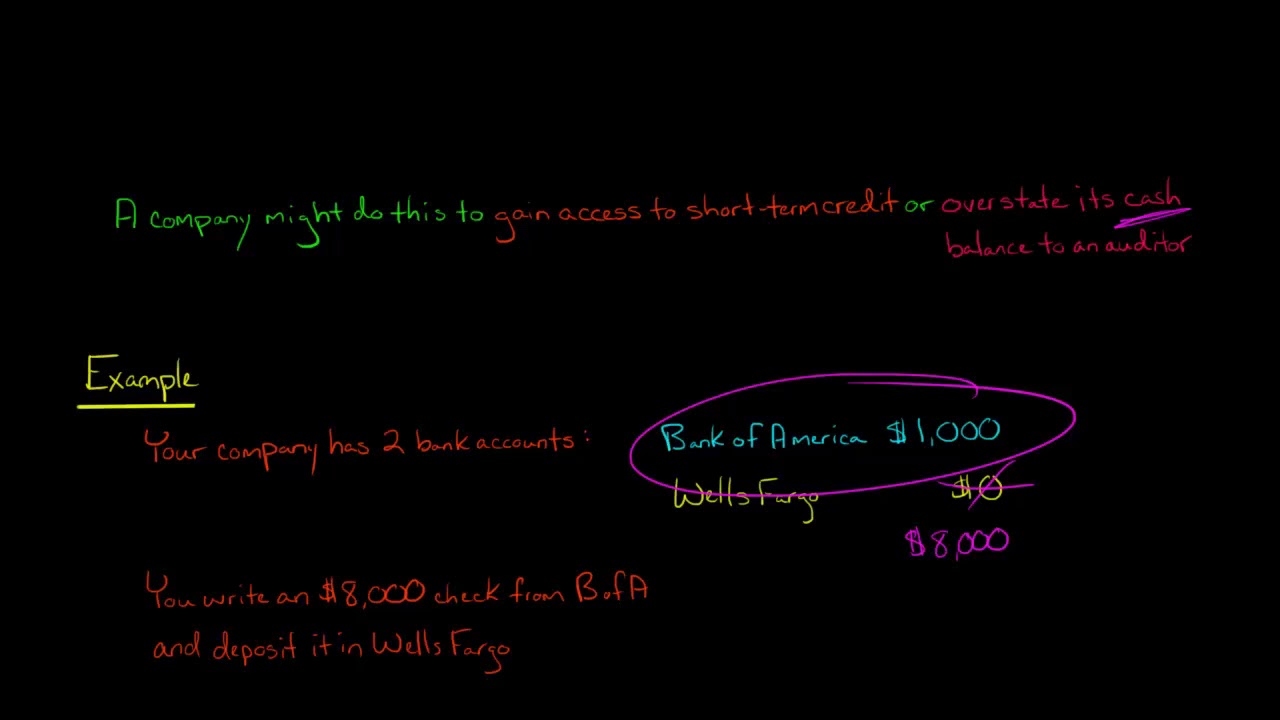

Check Kiting (fraud scheme)

Images related to the topicCheck Kiting (fraud scheme)

Is kiting checks illegal?

Check kiting is the illegal process of writing a check off of a bank account with inadequate funds to cover that check. Check kiting relies on the fact that it takes banks a few days (or even longer for international checks) to determine that a check is bad.

Does check kiting involve two bank accounts?

Check kiting is a common form of white-collar crime and check fraud. It involves drawing a check for a greater amount than is contained in the account. The check is then deposited into a different account. Before the check clears with the first account, the funds are immediately withdrawn from the second account.

How do you prove check kiting?

Under California state law, Penal Code § 476a is how check kiting is prosecuted. To be convicted of this, the prosecution must prove that one knowingly wrote a check knowing there were insufficient funds to cover the full amount of the check and in doing so, hoped to obtain something in return for passing the check.

What is the difference between lapping and kiting?

What is the difference between lapping and kiting? Lapping occurs when cash is stolen upon receipt from one customer’s account. Later, the cash that is received from a second account is applied to the first account to cover up the original theft.

What happens if you unknowingly deposit a fake check?

The consequences of depositing a fake check — even unknowingly — can be costly. You may be responsible for repaying the entire amount of the check. While bank policies and state laws vary, you may have to pay the bank the entire amount of the fraudulent check that you cashed or deposited into your account.

See some more details on the topic Do banks prosecute check kiting? here:

What Is Check Kiting? The Defenses? The Punishment?

Under California state law, Penal Code § 476a is how check kiting is prosecuted. To be convicted of this, the prosecution must prove that one knowingly wrote a …

What Is Check Kiting? | SQN Banking Systems

Also called flagging, check kiting is a form of check fraud. It uses float (the time it takes for a check to clear) to make use of non-existent money in a …

What Is Check Kiting? | LegalMatch

Check kiting is a form of check fraud. If you are a victim or involved in check kitting issues, contact a criminal defense lawyer.

CHECK KITING: DETECTION, PROSECUTION, AND …

The authors discuss what can be done about check kiting–the fraudulent use of checks between two or more bank accounts to cover the fact of insufficient funds.

How do I stop check kiting?

- Only accept checks for the exact amount owed to you. …

- Wait until the check clears to refund the overpayment. …

- Look into checks that clear your bank account out of sequence. …

- Restrict access to company checks if you’re a business owner.

What is check kiting and why is it illegal?

While it might seem like it is a clever way to get the money they need, it’s a form of fraud that’s illegal. Check kiting essentially turns a bad check into a form of credit, but this isn’t authorized and it can lead to trouble for banks. A person who’s caught doing this can face criminal charges and civil charges.

What happens if I write a check for more than I have?

If you write a check and there isn’t enough in your account to cover it, it will be returned to the person or entity who tried to deposit it. This is known as bouncing a check. Bounced checks are also called rubber checks, and the technical finance term for this situation is called non-sufficient funds, or NSF.

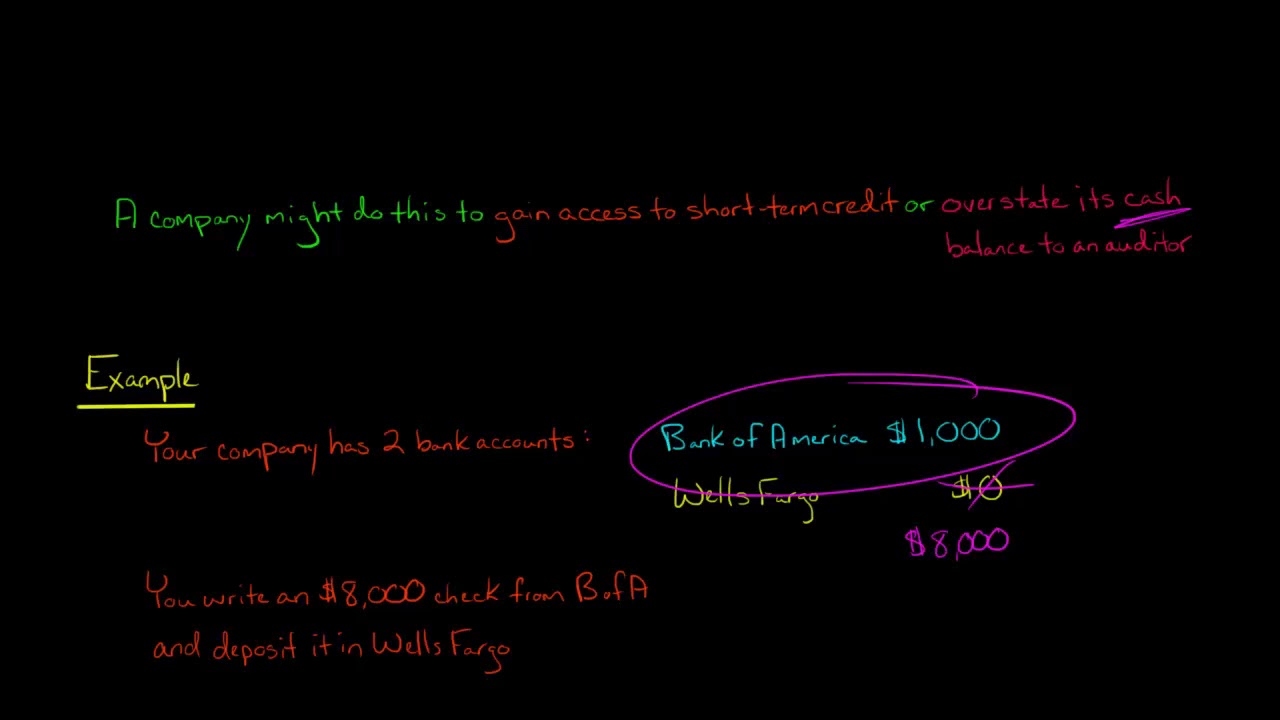

Example: Check Kiting | Auditing and Attestation | CPA Exam

Images related to the topicExample: Check Kiting | Auditing and Attestation | CPA Exam

Is check kiting money laundering?

Kiting is the fraudulent use of a financial instrument to obtain additional credit that is not authorized. Kiting encompasses two main types of fraud: Issuing or altering a check or bank draft, for which there are insufficient funds.

What is ACH kiting?

In ACH check kiting, a criminal will juggle money bank and forth between accounts at separate banks so that the ACH is registered as valid when it is checked, but then the money is gone by the time the transfer goes through.

Which of the following is an example of a check kiting scheme?

A simple example of check kiting is to write a check from Bank A, where you have insufficient funds, and deposit that check into an account at Bank B, which also lacks funds.

Can I write a check to myself with no money in my account?

Knowingly writing a check with no money on your account is also called check kiting. And it is illegal. It’s a fraudulent action that allows people to misuse the system and get access to otherwise non-existing funds.

Is lapping illegal?

Lapping is the illegal form of “robbing Peter to pay Paul.” Essentially it is a common method of skimming money from a company by using receipts from one account to cover theft from another. Learn how to spot this method of fraud to protect your business.

How do employees commit lapping?

Lapping occurs when an employee alters accounts receivable records in order to hide the theft of cash. This is done by diverting a payment from one customer, and then hiding the theft by diverting cash from another customer to offset the receivable from the first customer.

What does lapping mean in auditing?

Key Takeaways. A lapping scheme is a form of accounting fraud whereby stolen or misappropriated cash is obscured by an employee who altes the accounts receivable. A forensic accounting audit of cash receipts can be undertaken to reveal a lapping scheme, which may show increased age of accounts receivables.

Can you go to jail for depositing fake check?

According to federal laws, intentionally depositing a fake check to get money that is not yours is an act of fraud. Just like any other act of fraud, you can go to jail or face fines.

What is CHECK KITING? What does CHECK KITING mean? CHECK KITING meaning, definition explanation

Images related to the topicWhat is CHECK KITING? What does CHECK KITING mean? CHECK KITING meaning, definition explanation

How do banks investigate unauthorized transactions?

The bank initiates a payment fraud investigation, gathering information about the transaction from the cardholder. They review pertinent details, such as whether the charge was a card-present or card-not-present transaction. The bank also examines whether the charge fits the cardholder’s usual purchasing habits.

How do banks verify checks?

Banks can verify checks by checking the funds of the account it was sent from. It’s worth noting that a bank will not verify your check before it processes it, meaning you may face fees for trying to cash a bad check. The bank checks if there are funds in the account, and if not, the check bounces.

Related searches to Do banks prosecute check kiting?

- what is check floating

- what is it called when a person writes a check on a closed account

- 18 u.s.c. § 1344

- how often do banks prosecute for check kiting

- is check kiting a felony

- check kiting example

- is check kiting money laundering

- do banks prosecute check kiting

- car kiting

- what is a truncated check why are they important

- signs of check kiting

- can you go to jail for check kiting

- whats check kiting

- 18 u s c 1344

- what does check kiting mean in banking

- my bank closed my account for check kiting

Information related to the topic Do banks prosecute check kiting?

Here are the search results of the thread Do banks prosecute check kiting? from Bing. You can read more if you want.

You have just come across an article on the topic Do banks prosecute check kiting?. If you found this article useful, please share it. Thank you very much.