Table of Contents

What is the difference between ECL and CECL?

Let’s dive a bit deeper into why this happens. CECL focuses on the expected credit losses over the life of a loan, which means it considers the possibility of future economic downturns. During good times, this forward-looking approach can lead to higher impairment charges. ECL, on the other hand, looks at the credit losses that are likely to occur in the current economic climate. This means that ECL might not fully capture potential future losses, making it potentially less sensitive to economic shocks.

Think of it this way: CECL is like a cautious investor who anticipates potential bumps in the road, while ECL is more like a risk-taker who focuses on the current situation. During periods of economic growth, CECL might be more conservative, while ECL might appear more optimistic. However, when a crisis hits, CECL might have already built in some protection, while ECL could face a greater impact.

It’s important to note that the CECL and ECL methods are just tools, and the best approach will depend on the specific circumstances of each institution.

What’s the difference between CCAR and DFAST?

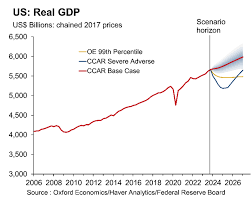

CCAR, which stands for Comprehensive Capital Analysis and Review, is a stringent annual stress test that larger banks must undergo. These are banks with assets exceeding $10 billion. CCAR aims to assess whether a bank has sufficient capital to withstand severe economic downturns and continue lending to businesses and individuals.

DFAST, or Dodd-Frank Act Stress Test, is designed for smaller banks with assets below $10 billion. Although DFAST is less demanding than CCAR, it’s still crucial for ensuring smaller banks have adequate capital reserves to navigate economic difficulties.

Both CCAR and DFAST are important regulatory tools designed to ensure financial stability. The Federal Reserve, which oversees these stress tests, uses them to monitor the health of the banking system and identify potential risks. The results of these tests can influence a bank’s ability to make loans, pay dividends, and even acquire other companies.

So, while CCAR is a more comprehensive and demanding test for large banks, DFAST plays a vital role in ensuring the financial health of smaller institutions. Both tests serve as essential safeguards to protect the overall financial system from potential shocks.

What is the difference between incurred loss method and CECL?

Think of it this way: CECL is like having a financial “crystal ball” that allows you to see potential losses on the horizon. This foresight allows for better financial planning and management. The incurred loss method, on the other hand, is like putting out fires after they have started. While it is effective in addressing immediate issues, it can be less efficient and potentially lead to more significant losses in the long run.

The CECL model is designed to provide a more comprehensive and accurate view of credit risk, which in turn allows for better decision-making and risk management. CECL encourages financial institutions to anticipate and manage potential losses before they materialize, ultimately leading to a more stable and resilient financial system.

What is the difference between stress testing and CECL?

Let’s break down the differences:

CECL (Current Expected Credit Losses) is a new accounting standard that requires companies to estimate and record credit losses on their financial statements. It’s primarily focused on financial reporting and how companies present their financial health. CECL is about measuring and accounting for the expected credit losses on loans and other financial assets.

Stress Testing, on the other hand, is a more forward-looking exercise. It’s used to assess the resilience of a company or financial institution under adverse economic conditions. Stress tests help to identify potential weaknesses in a company’s portfolio and highlight areas where improvements are needed. They are a critical tool for regulators and institutions to manage risk and ensure the stability of the financial system.

Here’s a simple analogy: imagine you’re planning a road trip. CECL would be like checking the condition of your car before you leave, ensuring everything is in working order. Stress Testing would be like mapping out different scenarios on your journey, like encountering bad weather or road closures. It helps you prepare for unexpected challenges and gives you options for navigating them.

While both CECL and stress testing are important for financial stability, they serve distinct purposes. CECL helps to accurately reflect credit losses on a company’s financial statements, while stress testing provides a proactive approach to managing risk and ensuring resilience.

What is CCAR vs CECL?

CCAR (Comprehensive Capital Analysis and Review) is all about stress testing. Think of it as a “what-if” scenario. Regulators ask banks to project how much money they would lose during a severe economic downturn. They want to make sure banks have enough capital to weather the storm. CECL (Current Expected Credit Losses) takes a different approach. It focuses on the long-term. Banks need to estimate the losses they expect to experience over the entire life of their loans, taking into account economic conditions and the likelihood of borrowers defaulting.

Here’s a helpful way to think about it:

CCAR: Imagine a bank is playing a game of “what if” with the regulators. “What if there’s a sudden recession?” The bank has to show it can handle the losses.

CECL: The bank is looking into the future and making a best-guess estimate about its potential losses over the next several years, considering both good and bad economic times.

So, the main difference is that CCAR focuses on a specific, extreme scenario, while CECL takes a more long-term view, considering a range of economic possibilities.

The information banks gather during CCAR can actually be quite useful for CECL. Let’s say a bank discovers it would experience significant losses during a recession. This information can help them build a more accurate CECL model by incorporating this potential for increased losses over the long term. In essence, CCAR provides a baseline for CECL.

What is the IFRS equivalent of CECL?

The IFRS 9 standard offers a similar approach to recognizing expected credit losses called ECL (Expected Credit Losses). Now, a key difference between CECL and ECL lies in how they calculate those losses.

While CECL requires you to calculate lifetime expected credit losses for all financial assets right from their inception, IFRS 9 introduces a more nuanced approach: a dual credit loss measurement approach.

This means that the loss allowance is calculated differently depending on the stage of the financial asset’s life. Here’s how it works:

1. Stage 1: The “Good” Stage

In this stage, the borrower’s creditworthiness is considered “good” and the loss allowance is calculated based on the 12-month expected credit losses, meaning only losses that are expected to be incurred over the next 12 months. Think of it like a “short-term” view of potential losses.

2. Stage 2: The “Watchful” Stage

Now, we move to a stage where there’s a bit more uncertainty. This “watchful” stage applies to borrowers whose creditworthiness has deteriorated significantly since the initial recognition of the financial asset. In this stage, the loss allowance is measured at lifetime expected credit losses. This “long-term” perspective accounts for potential losses over the entire life of the financial asset.

3. Stage 3: The “Impaired” Stage

In the final stage, the borrower’s creditworthiness has reached a point of “impairment.” The asset is considered “impaired,” and the loss allowance is calculated at the lifetime expected credit losses. This stage requires you to consider the expected losses over the entire life of the impaired financial asset.

In summary, IFRS 9 emphasizes a staged approach to credit loss measurement, allowing for a more flexible and tailored approach to estimating and accounting for expected credit losses. This dynamic approach contrasts with the straightforward, lifetime approach mandated by CECL.

See more here: What’S The Difference Between Ccar And Dfast? | Difference Between Ccar And Cecl

What is the difference between CCAR and CCEL?

CCAR (Comprehensive Capital Analysis and Review) is a stress-testing process that banks are required to complete twice a year. It assesses a bank’s capital adequacy under a set of severe economic scenarios. Banks use data from the end of December to run these stress tests, and the process takes about three months.

CCEL (Current Expected Credit Losses) is a more accounting-focused approach. It is used to estimate credit losses on loans over the life of the loan. Unlike CCAR, which is a regulatory requirement, CCEL is an accounting standard that is used to ensure that banks are setting aside enough money to cover potential credit losses.

Here’s a deeper dive into the differences between CCAR and CCEL:

Focus:CCAR focuses on a bank’s ability to withstand severe economic conditions, while CCEL focuses on accounting for credit losses on individual loans.

Timing:CCAR is conducted twice a year, while CCEL is used to estimate credit losses over the life of a loan.

Data:CCAR uses data from the end of December, while CCEL considers all available information about a loan’s creditworthiness.

Purpose:CCAR helps regulators assess the overall health of the banking system, while CCEL ensures that banks are adequately accounting for credit losses.

While CCAR and CCEL have different purposes, they both play an important role in managing risk and ensuring the stability of the financial system.

What is the difference between CCAR and CECL?

While CCAR models can be a helpful starting point for CECL, they are distinct. CCAR, the Comprehensive Capital Analysis and Review, is a stress test designed to assess a bank’s capital adequacy under adverse economic conditions. It’s conducted by the Federal Reserve twice a year.

CECL, on the other hand, is the Current Expected Credit Losses accounting standard that dictates how banks estimate and account for credit losses. CECL focuses on the expected credit losses over the life of a loan, considering a wider range of factors than just the current economic climate.

Let me clarify the data aspect you mentioned:

CCAR uses data as of the end of December for its stress-testing process. This means banks use the latest available information at that time to simulate various economic scenarios.

CECL, on the other hand, requires banks to consider a broader range of data, including forward-looking information, to estimate credit losses. This means banks must use data that reflects their expectations of future economic conditions and the performance of their loan portfolio.

The key takeaway here is that CCAR focuses on a snapshot of a bank’s financial health at a particular point in time (end of December), while CECL requires a more forward-looking approach, considering the expected performance of loans over their entire lifespan.

Let me illustrate this with an example. Imagine a bank has a portfolio of loans to small businesses. Under CCAR, the bank would assess the potential impact of a recession on those loans based on data as of the end of December. This might include metrics like unemployment rates, GDP growth, and default rates. However, under CECL, the bank would need to consider a broader range of factors, including industry trends, the specific financial health of the borrowers, and the bank’s own internal data on loan performance. This allows the bank to develop a more nuanced and comprehensive estimate of credit losses over the life of the loans, regardless of the current economic conditions.

Are CCAR models suitable for CECL?

However, CECL is different. CECL requires a Through-the-Cycle (TTC) perspective. This means we need to consider a wider range of economic scenarios, including those that are less likely but could still have a significant impact. CECL also looks at the entire life of a loan, not just its current state.

Here’s why CCAR models, designed for PIT, might not always be ideal for CECL:

CCAR models tend to rely heavily on macroeconomic factors, such as GDP growth and unemployment rates. While these are important, they don’t capture all the nuances of individual loan performance.

CCAR models can sometimes be backward-looking, incorporating historical default experiences. This can be helpful for understanding past trends but might not be the best guide for predicting future losses, especially in a rapidly changing economic environment.

So, can CCAR models be used for CECL? It depends. You can certainly use the insights and data from CCAR models as a starting point. But, you’ll likely need to adapt them and supplement them with other data sources to meet CECL’s requirements.

For example, CECL requires you to consider a broader range of factors, such as:

Credit quality of borrowers: This involves analyzing individual borrower characteristics like their credit history, income, and debt-to-income ratio.

Specific industry trends: Instead of just relying on macroeconomic factors, you need to understand the specific economic outlook for the industries your borrowers operate in. This might require you to look at industry-specific data like supply chain disruptions, commodity price fluctuations, or consumer spending patterns.

Loan terms and features: The structure of a loan, such as its interest rate, maturity, and collateral, can significantly impact its expected loss.

You’ll also need to develop models that can simulate different economic scenarios and project how loan losses might change under these scenarios. This involves considering things like:

Recessions: What would happen to loan losses if the economy enters a recession? How deep would the recession be, and how long would it last?

Interest rate changes: How would changes in interest rates impact borrower behavior and loan performance?

Changes in regulations: New regulations can impact lending practices and default rates.

Essentially, CECL requires a more granular and forward-looking approach than CCAR. While CCAR provides a solid foundation, you’ll need to build on it and incorporate additional data and analytical techniques to meet the requirements of CECL.

What does CECL stand for?

This new standard impacts how banks and other financial institutions estimate and account for potential credit losses. Previously, they used a simpler method called “incurred loss” accounting. This meant they only recognized losses when they actually happened.

With CECL, the focus shifts to “expected” losses. Financial institutions are now required to estimate the amount of credit losses they expect to experience over the lifetime of their loans and other financial assets. This new standard aims to provide a more realistic and forward-looking approach to accounting for potential losses.

CECL is a significant change for the banking industry. It requires financial institutions to make more complex estimates and use sophisticated modeling techniques. It also impacts their financial statements and capital planning.

The Comprehensive Capital Analysis and Review (CCAR) is a process that the Federal Reserve uses to assess the financial health of large banks. Beginning in 2020, the CCAR requires banks to incorporate the impact of CECL into their stressed projections. This means that banks need to consider how CECL could affect their financial performance in a variety of economic scenarios.

See more new information: musicbykatie.com

Difference Between Ccar And Cecl: What You Need To Know

You might be wondering, what is the difference between CCAR and CECL? It’s a question many financial professionals are grappling with, especially those in the banking industry. It all comes down to how banks set aside money for loan losses. Let’s break it down.

CCAR stands for Capital adequacy and CCAR is the stress test that the Federal Reserve conducts on systemically important financial institutions to make sure they have enough capital to weather a financial crisis.

Think of it this way. The Fed wants to make sure that even if the economy goes south, banks have enough money to keep lending. They can’t just let the whole thing crumble, right?

CECL, on the other hand, is all about how banks estimate how much money they might lose on loans. It’s an accounting standard that the Financial Accounting Standards Board (FASB) created. This standard requires banks to make more realistic estimates of credit losses, taking into account not just historical data, but also current economic conditions and future expectations.

So, CCAR is about capital, and CECL is about credit losses. They’re different, but they are connected. The Fed looks at the capital banks hold when they do their stress tests, and they take into account how the CECL requirements might impact those capital levels.

Here’s a simplified breakdown:

CCAR:

Focus: Capital adequacy

Goal: Ensure banks have enough capital to weather a financial crisis

Authority: Federal Reserve

Application: Systemic financial institutions

CECL:

Focus: Estimating credit losses

Goal: Ensure banks make realistic estimates of credit losses

Authority: Financial Accounting Standards Board (FASB)

Application: All banks

Now, let’s talk about why this is so important.

Before CECL, banks used a pretty simple method to estimate credit losses. They looked at historical data, like how many loans had gone bad in the past. But that approach didn’t always capture the full picture, especially when economic conditions were changing rapidly.

CECL changed things by asking banks to consider the current economy, future economic outlook and how that might affect their loan portfolio. This made things a little more complicated, but it also created a more realistic and transparent way for banks to account for potential credit losses.

The Impact of CECL on CCAR

You might be asking, how does CECL affect the CCAR stress test? Good question!

Think of it this way: CECL makes banks set aside more money for potential credit losses. This can lower their capital levels, which the Fed watches closely when they do their stress tests.

If a bank has lower capital because they’ve set aside more money for CECL, the Fed might ask them to take additional steps to strengthen their capital position. This could mean things like:

Reducing dividends

Holding more capital reserves

Limiting lending

It’s all about making sure banks are prepared for any financial storms that might come their way.

Frequently Asked Questions (FAQs)

1. What is the difference between CCAR and CECL?

CCAR is a stress test conducted by the Federal Reserve to ensure systemically important financial institutions have enough capital to weather a financial crisis.

CECL is an accounting standard from the FASB that requires banks to make more realistic estimates of credit losses, considering not just historical data but also current economic conditions and future expectations.

2. Why are CCAR and CECL important?

CCAR helps to ensure the stability of the financial system by making sure banks have enough capital to handle a crisis.

CECL promotes transparency and accuracy in how banks account for potential credit losses, which helps investors and regulators understand the true financial health of banks.

3. How does CECL affect CCAR?

CECL can lower a bank’s capital levels because it requires banks to set aside more money for credit losses.

* This can have an impact on the Fed’s assessment of the bank’s capital adequacy during the CCAR stress test.

4. What are the main challenges associated with implementing CECL?

Data collection and modeling: CECL requires banks to collect and use a lot of data, including economic forecasts and future expectations. This can be a challenging process.

Complexity: The CECL standard is complex, and it requires banks to make significant changes to their accounting systems.

Potential impact on capital levels: CECL can reduce a bank’s capital levels, which could affect its ability to lend and grow its business.

5. What are some best practices for implementing CECL?

Start early: Implementing CECL takes time. Start early so you have enough time to gather data, develop models, and train your staff.

Get support from experts: Don’t go it alone! Seek help from consultants, technology providers, and other experts who have experience with CECL implementation.

Communicate clearly with stakeholders: Keep your investors, regulators, and other stakeholders informed about your CECL implementation process and any potential impacts.

CECL and CCAR are both important for the health and stability of the financial system. By understanding how these two regulations work together, we can better understand how banks are prepared to face the challenges of a changing economic landscape.

CECL Vs CCAR – Finextra Research

Differences Between CCAR and CECL. Although CECL has many similarities to CCAR, there are a few key differences that cannot be neglected. CCAR models are actually a good starting point for CECL… Finextra Research

CECL Forecasts & Scenarios FAQs – Moody’s Analytics

CCAR and CECL are two different processes with different purposes, although they have the common objective of forecasting losses under varying economic conditions. The Moody’s Analytics

Implementing IFRS 9 and CECL: Practical Insights

Stated differently, CECL follows a single credit-loss measurement approach, whereas IFRS 9 follows a dual credit-loss measurement approach in which expected credit losses are measured Deloitte

CECL CECL Forecasts & Scenarios FAQs – Moody’s Analytics

CCAR and CECL are two different processes with different purposes, although they have the common objective of forecasting losses under varying economic conditions. Deloitte

Comprehensive Capital Analysis and Review 2020

Incorporation of the current expected credit loss (CECL) methodology: Beginning in CCAR 2020, all firms are required to incorporate the impact of the Financial Accounting Federal Reserve Board

Current Expected Credit Losses (CECL) — Focusing on the

Every bank must comply with CECL — and CECL will be more challenging. Like Basel II – aData and models are key and CECL requires the precision and controls to support a Deloitte

CECL Vs CCAR – Finextra Research

Location. New York. Followers. 5. Opinions. 46. Follow. CECL vs. CCAR: A Significant Change in the Banking Industry. In an effort to reinforce the financial finextra.com

Current Expected Credit Loss (CECL) Implementation

Perspectives. Current expected credit losses. On the Radar: Insights on implementing the CECL model. The current expected credit loss (CECL) model under Accounting Deloitte

A Framework for Multiple Economic Scenarios Under CECL

DFAST/CCAR scenarios can provide guidance, but there are important differences between the DFAST/CCAR scenarios and what is expected under CECL. FI Consulting

What Is Ccar (Comprehensive Capital Analysis And Review) Reporting?

What Is Cecl?

Credit Losses: Introduction To The Cecl Model

Cecl And Ifrs9: The Basics

Current Expected Credit Losses Methodology

Asc 326 Cecl Accounting Standard Implementation Guide

Credit Risk | Pra | Eba | Fed | Rbi | Basel | Crdiv | Crr | Ifrs 9 | Cecl | All | Icaap | Ccar Dfast

Stress Testing | Ccar | Dfast | Scenario Analysis | 9 Quarter Backtesting | Peaks2Tails

Link to this article: difference between ccar and cecl.

See more articles in the same category here: https://musicbykatie.com/wiki-how/