Are you looking for an answer to the topic “Does adjusted gross income include capital gains?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

While capital gains may be taxed at a different rate, they are still included in your adjusted gross income, or AGI, and thus can affect your tax bracket and your eligibility for some income-based investment opportunities.Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income.Capital gains will not cause your ordinary income to be taxed at a higher rate. This is obviously good. Capital gains will increase your adjusted gross income (AGI), and this can cause you to lose eligibility to contribute to an IRA or a Roth IRA, and you could be phased out of itemized deductions and some tax credits.

Table of Contents

Are capital gains included in AGI?

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income.

Do capital gains affect adjusted gross income?

Capital gains will not cause your ordinary income to be taxed at a higher rate. This is obviously good. Capital gains will increase your adjusted gross income (AGI), and this can cause you to lose eligibility to contribute to an IRA or a Roth IRA, and you could be phased out of itemized deductions and some tax credits.

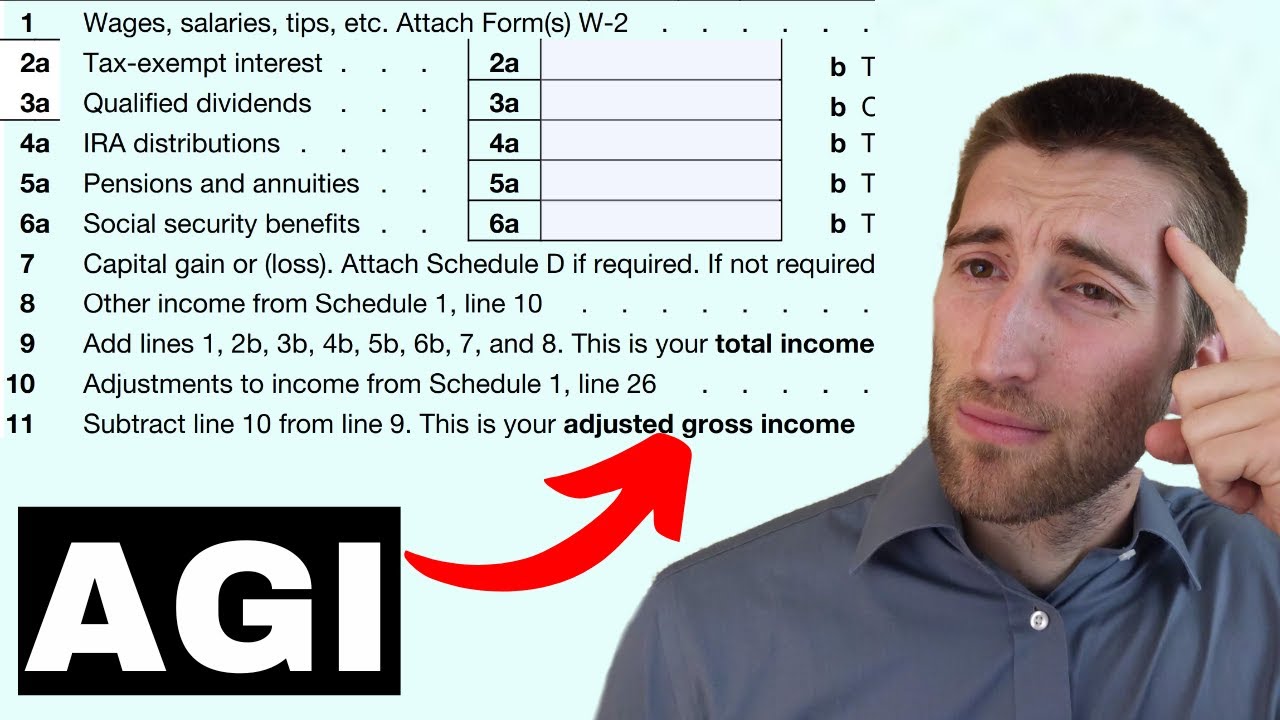

Adjusted Gross Income Explained (For Anyone To Understand!)

Images related to the topicAdjusted Gross Income Explained (For Anyone To Understand!)

Is capital gains tax based on gross income or adjusted gross income?

You may qualify for the 0% long-term capital gains rate, depending on taxable income, according to financial experts. You calculate taxable income by subtracting the greater of the standard or itemized deductions from your adjusted gross income, which are your earnings minus so-called “above-the-line” deductions.

What is included in adjusted gross income?

Adjusted gross income is your gross income — which includes wages, dividends, alimony, capital gains, business income, retirement distributions and other income — minus certain payments you’ve made during the year, such as student loan interest or contributions to a traditional individual retirement account or a health …

Does total taxable income include capital gains?

Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or exchanged at a price higher than its basis. Basis is an asset’s purchase price, plus commissions and the cost of improvements less depreciation.

Do capital gains count towards income bracket?

2021 capital gains tax rates

Short-term capital gains are taxed as ordinary income according to federal income tax brackets.

Is capital gains added to your total income and puts you in higher tax bracket?

Ordinary income is calculated separately and taxed at ordinary income rates. More long-term capital gains may push your long-term capital gains into a higher tax bracket (0%, 15%, or 20%), but it will not affect your ordinary income tax bracket.

See some more details on the topic Does adjusted gross income include capital gains? here:

Definition of Adjusted Gross Income | Internal Revenue Service

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, …

What Is Adjusted Gross Income (AGI)? – NerdWallet

Adjusted gross income is your gross income — which includes wages, dividends, alimony, capital gains, business income, retirement distributions and other …

Adjusted Gross Income (AGI) Definition | TaxEDU – Tax …

Adjusted gross income (AGI) is a taxpayer’s total income minus certain “above-the-line” deductions. It is a broad measure that includes income from wages, …

Can Capital Gains Push Me Into a Higher Tax Bracket? —

Bad news first: Capital gains will drive up your adjusted gross income (AGI). As your AGI increases, you begin to get phased out of itemized …

Income Tax: Gross Income, Adjusted Gross Income, and Taxable Income

Images related to the topicIncome Tax: Gross Income, Adjusted Gross Income, and Taxable Income

How do I report capital gains on my taxes?

Capital gains and deductible capital losses are reported on Form 1040, Schedule D, Capital Gains and Losses, and then transferred to line 13 of Form 1040, U.S. Individual Income Tax Return. Capital gains and losses are classified as long-term or short term.

What reduces AGI?

Contributing money to a retirement plan at work like a 401(k) plan can reduce a taxpayer’s AGI. Investing in a traditional IRA plan is another way to save for retirement and lower AGI. Self-employed SEP, SIMPLE, and qualified plans are also retirement options that can lower AGI.

How can I reduce my adjusted gross income 2021?

- Contribute to a Health Savings Account. …

- Bundle Medical Expenses. …

- Sell Assets to Capitalize on the Capital Loss Deduction. …

- Make Charitable Contributions. …

- Make Education Savings Plan Contributions for State-Level Deductions. …

- Prepay Your Mortgage Interest and/or Property Taxes.

What is the difference between adjusted gross income and taxable income?

Taxable income is the income earned by an individual or business entity less expenses and deductions. Adjusted gross income is the taxable income of an individual which includes income from all sources.

How do I calculate my gross income?

You simply add up all of your income sources before any tax deductions or taxes. For example, if last year you earned $100,000 in salary, $1,000 in interest income, and $12,000 in rental income, your gross income for the year would be $100,000 + $1,000 + $12,000 = $113,000.

What is Modified Adjusted Gross Income, or MAGI?

Images related to the topicWhat is Modified Adjusted Gross Income, or MAGI?

What is the capital gains exemption for 2021?

For example, in 2021, individual filers won’t pay any capital gains tax if their total taxable income is $40,400 or below. However, they’ll pay 15 percent on capital gains if their income is $40,401 to $445,850. Above that income level, the rate jumps to 20 percent.

What are the capital gains tax brackets for 2020?

Long Term Capital Gain Brackets for 2020

Long-term capital gains are taxed at the rate of 0%, 15% or 20% depending on your taxable income and marital status. For single folks, you can benefit from the zero percent capital gains rate if you have an income below $40,000 in 2020.

Related searches to Does adjusted gross income include capital gains?

- does adjusted gross income include capital gains

- agi calculator

- are long term capital gains included in agi

- does adjusted net income include capital gains

- does adjusted income include capital gains

- what line on 1040 is adjusted gross income 2020

- adjusted gross income vs taxable income

- what is adjusted gross income

- does modified adjusted gross income include long term capital gains

- do capital gains count as income

- is capital gain included in adjusted gross income

- does gross income include capital gains

- what is adjusted gross income example

- what is adjusted gross income on w2

- are capital gains considered adjusted gross income

- are capital gains included in your agi

- is capital gains figured on adjusted gross income

- does adjusted gross income include long term capital gains

- are capital gains in adjusted gross income

- does modified adjusted gross income include capital gains

Information related to the topic Does adjusted gross income include capital gains?

Here are the search results of the thread Does adjusted gross income include capital gains? from Bing. You can read more if you want.

You have just come across an article on the topic Does adjusted gross income include capital gains?. If you found this article useful, please share it. Thank you very much.