Are you looking for an answer to the topic “Do fidelity bonds have deductibles?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

A deductible is the amount that you pay out of your own pocket for a claim before an insurance company will provide coverage. Deductibles on fidelity bonds can be as high as $150,000 but more common deductibles are $10,000, $25,000 and $50,000.Deductibles. ERISA requires the bond insures the plan from the first dollar of loss. Therefore, bonds cannot have deductibles or similar features whereby a portion of the risk required to be covered by the bond is assumed by the plan.The general requirement is that a plan must have a fidelity bond equal to at least 10% of the total assets in the plan. Under this general rule, the minimum bond amount is $1,000 (covers you on total assets up to $10,000), and the maximum bond is $500,000 (for plans with assets of more than $5 million).

Table of Contents

Do bonds have deductibles?

Deductibles. ERISA requires the bond insures the plan from the first dollar of loss. Therefore, bonds cannot have deductibles or similar features whereby a portion of the risk required to be covered by the bond is assumed by the plan.

How much should a fidelity bond cover?

The general requirement is that a plan must have a fidelity bond equal to at least 10% of the total assets in the plan. Under this general rule, the minimum bond amount is $1,000 (covers you on total assets up to $10,000), and the maximum bond is $500,000 (for plans with assets of more than $5 million).

Top 5 Fidelity Index Funds (Bonds Edition)

Images related to the topicTop 5 Fidelity Index Funds (Bonds Edition)

What do fidelity bonds cover?

An ERISA fidelity bond is a type of insurance that protects the plan against losses caused by acts of fraud or dishonesty. Fraud or dishonesty includes, but is not limited to, larceny, theft, embezzlement, forgery, misappropriation, wrongful abstraction, wrongful conversion, willful misapplication, and other acts.

Do ERISA bonds have a deductible?

A: ERISA bonds have several requirements as outlined by the statutory provisions of ERISA Section 412: The bond must have a minimum payout equal to at least 10% of the plan assets. However, the payout cannot be less than $1,000 or more than $1,000,000. The bond cannot have a deductible.

Are fidelity bonds expensive?

The cost of a fidelity bond is usually a small percentage of the bond’s total amount of coverage. That’s why the coverage size of the bond is the biggest factor in determining its cost. For example, the median cost of a $1 million fidelity bond, our most popular option, is $1,054 per year, or less than $90 per month.

What is the difference between a fidelity bond and a surety bond?

The main difference between fidelity and surety bonds is that surety bonds are required (usually by the government) and are legally binding contracts that state that if you don’t abide by the terms of the bond and cause claims, you’re required to pay them in full.

How much is a 50000 fidelity bond?

| Bond Amount | Premium (Per Year) |

|---|---|

| $40,000 | $229 |

| $50,000 | $257 |

| $75,000 | $320 |

| $100,000 | $359 |

See some more details on the topic Do fidelity bonds have deductibles? here:

401(k) Fidelity Bonds – Frequently Asked Questions

A 401(k) plan can purchase more coverage, but it’s not required. Further, an ERISA fidelity bond can’t have a deductible – in other words, it …

Fidelity Bonds Definition and Requirements | DWC

Does a fidelity bond provide coverage similar to fiduciary liability insurance? … No. Unlike a fidelity bond that protects the plan, fiduciary liability …

10 Facts You Should Know Regarding ERISA Fidelity Bonds

Deductibles. ERISA requires the bond insures the plan from the first dollar of loss. Therefore, bonds cannot have deductibles or similar …

ERISA Fidelity Bond and Fiduciary Liability Insurance | SobelCo

Question: Can an ERISA bond have a deductible? … The answer to this question is “no.” If the policy you are reviewing contains a “deductible,” the coverage you …

How much should a fidelity bond be on a 401k plan?

Typically, the bond needs to be at least 10% of the value of the plan assets. Regardless of the asset value, the bond must be at least $1,000 and need not be greater than $500,000.

How long do fidelity bonds last?

A fidelity bond’s term can’t be less than one year. However, it can be longer. Bonds that cover multiple years typically contain an “inflation guard” provision – so the plan’s coverage amount automatically satisfies ERISA each year.

What are two main types of fidelity bonds?

There are two types of fidelity bonds: first-party bonds (which protect companies from harmful acts by employees or clients) and third-party bonds (which protect companies from the harmful acts of contracted workers).

What is the difference between a fidelity bond and an ERISA bond?

An ERISA bond covers employees who manage or have fiduciary responsibility for the company’s retirement fund. A fidelity bond covers employees who may not be able to receive a bond due to concerns with their personal background or employment history.

What is the main difference between a fidelity bond and crime insurance?

While fidelity bonds protect against very specific employee-related crimes, a commercial crime insurance policy can be put together to offer your business more complete and diverse coverage against criminal activities that could cost your business money.

What is FIDELITY BOND? What does FIDELITY BOND mean? FIDELITY BOND meaning explanation

Images related to the topicWhat is FIDELITY BOND? What does FIDELITY BOND mean? FIDELITY BOND meaning explanation

What is the cost of an ERISA fidelity bond?

Most insurance companies charge between $100 to $300 per year for an ERISA fidelity bond.

Do I need a fidelity bond for my 401k?

Does my 401(k) plan require an ERISA fidelity bond? A fidelity bond is required as soon as you start your 401(k) plan. ERISA requires every person who handles funds or other property for an employee benefit plan, including 401(k) plans, to be bonded.

Is fiduciary liability the same as ERISA bond?

No, an ERISA fidelity bond and fiduciary liability insurance are not the same. An ERISA fidelity bond is required by law to cover plan losses as a result of fraud. Fiduciary liability insurance is not required, but it may be a good idea to help protect plan fiduciaries. The Department of Labor (DOL), under ERISA Sec.

Are there fees on bonds?

When a client wants to buy a bond that is not owned by the broker-dealer, the purchase has to take place on the open market. In this capacity, the firm acts as an agent for the client to buy the bond, for which it charges a commission. The commission can range from 1 to 5% of the market price of the bond.

How does a fidelity bond work?

A fidelity bond is a form of business insurance that offers an employer protection against losses that are caused by its employees’ fraudulent or dishonest actions. This form of insurance can protect against monetary or physical losses.

Can I buy I bonds through fidelity?

You can’t buy I-bonds in a brokerage account but Fidelity provides access to TIPS at auctions and in secondary markets. Would-be investors should be aware of differences between I-bonds and TIPS.

What is a blanket fidelity bond?

A blanket honesty bond is a fidelity bond that protects employers from losses due to dishonest acts of employees. The main benefit of blanket honesty bonds is that they prevent small companies from going bankrupt due to a single employee’s dishonesty.

How do you get fidelity bonded?

To qualify for a fidelity bond, the job seeker or employee must meet all of the following criteria: Provide verifiable proof of authorization to work in the United States. Have a firm job offer or commitment of employment with a reasonable expectation of permanence. Not be commercially bondable.

Who is the obligee on a fidelity bond?

Fidelity bonds guarantee the honesty of employees but are written in the name of the protected entity, the employer. Although they appear to be a two party agreement, in reality the employee is the principal and the employer is the obligee, so along with the bonding company there are three.

How much does a $100 bond cost?

Whether you buy savings bonds electronically or in paper form, most savings bonds are sold at face value. This means that if you buy a $100 bond, it costs you $100, on which you earn interest.

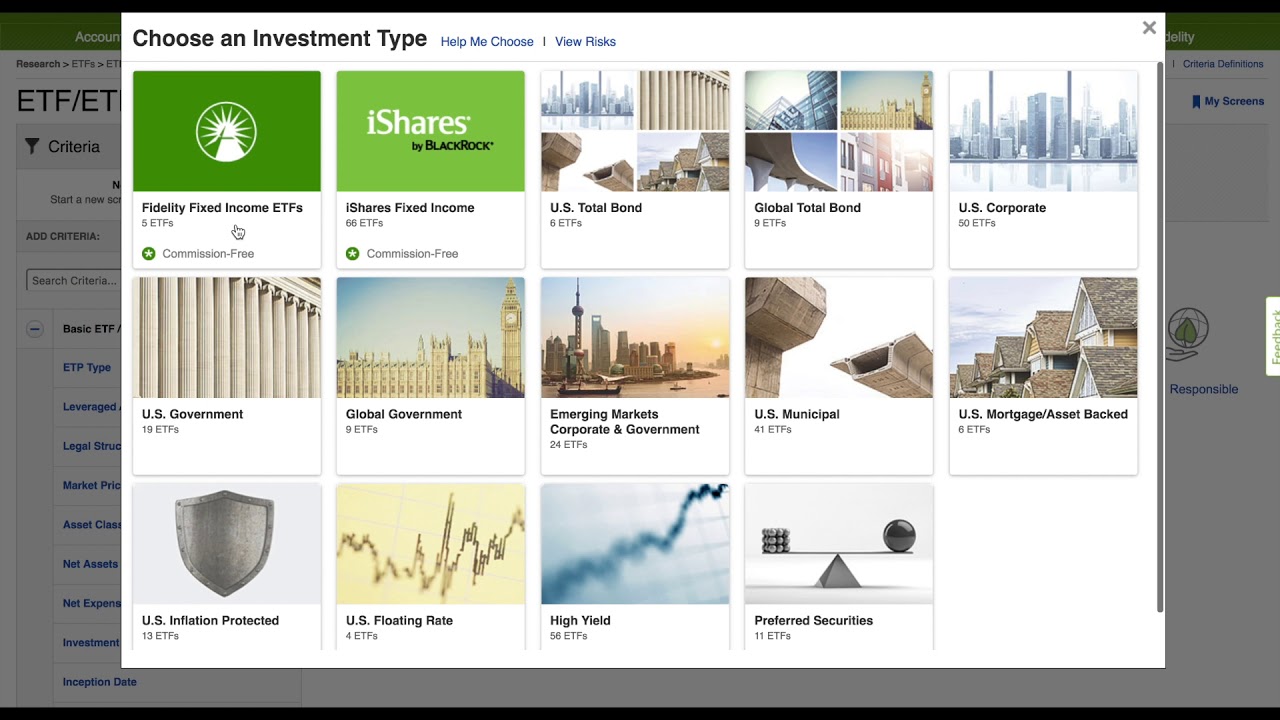

How to Buy Bonds and Bond ETFs with Fidelity

Images related to the topicHow to Buy Bonds and Bond ETFs with Fidelity

Why might a business person purchase a fidelity bond?

A fidelity bond is a type of business insurance. This bond offers an employer protection against losses that are caused by dishonest employees who commit fraud against the company. A fidelity bond can protect your business against both monetary losses and physical losses.

How much does a Treasury bond cost?

You pay the face value. For example, a $50 EE bond costs $50. EE bonds come in any amount to the penny for $25 or more. For example, you could buy a $50.23 bond.

Related searches to Do fidelity bonds have deductibles?

- how to get a fidelity bond

- do fidelity bonds have deductibles and copays

- what is a fidelity bond

- do fidelity bonds have deductibles and coinsurance

- erisa fidelity bond requirements 2020

- what is fidelity bond insurance

- what is a fidelity bond for 401k

- 401k fidelity bond provider

- erisa fidelity bond requirements 2021

- erisa fidelity bond cost

Information related to the topic Do fidelity bonds have deductibles?

Here are the search results of the thread Do fidelity bonds have deductibles? from Bing. You can read more if you want.

You have just come across an article on the topic Do fidelity bonds have deductibles?. If you found this article useful, please share it. Thank you very much.