Are you looking for an answer to the topic “Do VA appraisers know the contract price?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

The sales contract is just one more piece of data to be used in the appraisal process. Therefore, the appraiser will most likely know the selling price of a home but this is not always the case.3. Do VA appraisers know the selling price? Yes. When a VA appraisal is ordered by the lender, they are provided a copy of the executed sales contract.It depends on the Realtor. Some Realtors give us copies of all the offers while others only provide the contract that was accepted. If you have multiple offers I would ask your agent to inform the appraiser of all offers received.

Table of Contents

Does a VA appraiser know the purchase price?

3. Do VA appraisers know the selling price? Yes. When a VA appraisal is ordered by the lender, they are provided a copy of the executed sales contract.

Does the appraiser see the offer?

It depends on the Realtor. Some Realtors give us copies of all the offers while others only provide the contract that was accepted. If you have multiple offers I would ask your agent to inform the appraiser of all offers received.

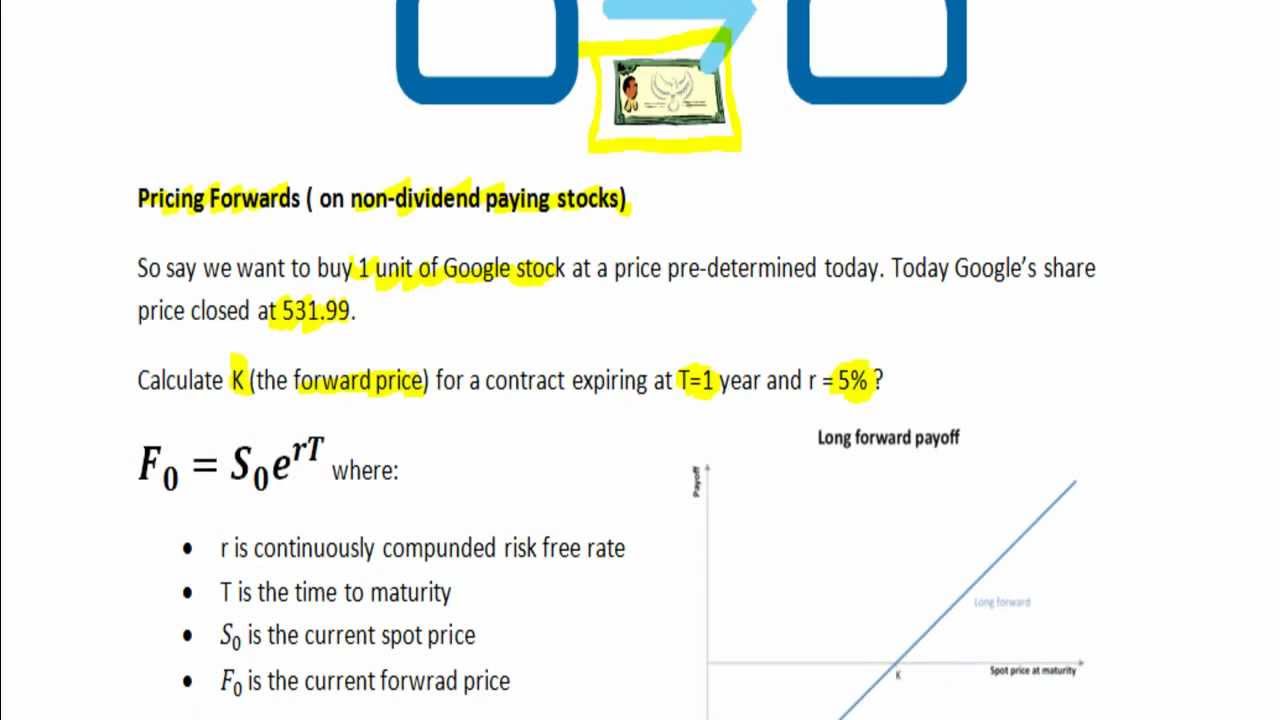

Forward Contracts #1 pricing (on stock with no dividends)

Images related to the topicForward Contracts #1 pricing (on stock with no dividends)

Do appraisers try to match purchase price?

To estimate the value of a house, an appraiser will look for similar homes that have sold recently. These homes are called comps, or comparables. Adjustments. The comps won’t be identical so the appraiser will have to make “adjustments” to the value of the comps to make them more comparable to the home under contract.

Does appraisal have to match purchase price or loan amount?

Ideally, the appraised value matches the price the buyer has agreed to pay. When a property appraises for less than the purchase price, the transaction can be in jeopardy. However, a low appraisal won’t necessarily stand in the way of the lender granting the loan if the borrowers are making a large cash down payment.

Do VA appraisals come in lower than conventional?

Like any other type of appraisal, VA appraisals can come in lower than you expected. The unfortunate reality is that some homes are overpriced by the seller. According to Fannie Mae, appraisals come in low around 8% of the time. With that, borrowers seeking a VA loan may find their appraisal comes in low.

What will fail a VA appraisal?

What will fail a VA appraisal? If a home fails to meet the VA’s Minimum Property Requirements (MPRs), the home will fail the VA appraisal. MPRs ensure the home is move-in ready so veterans won’t face a long list of expensive repairs after closing on the home.

Do appraisers adjust for appreciation?

If your sold comparable seems like it’s the perfect match for your subject, and would really put over the value you need to get funded, BUT, the contract or closing date is more than six months past (or less in rapid markets), make sure the appraiser considers adjustments for appreciation.

See some more details on the topic Do VA appraisers know the contract price? here:

VA Q&A – Top 5 Questions about VA Appraisals

ANSWER: No. VA appraisals can only be ordered by a VA-approved lender.3. Do VA appraisers know the selling price? Yes. When a VA appraisal is …

How VA Appraisers Determine a Home’s Value – Veterans …

The first step for a VA appraiser is to gather pertinent property information. Some of this information is gathered from the contract or public …

The Untold Truth of Home Appraisals – Real Estate Decoded

When the appraiser didn’t know the (future) contract price, only 45% of the appraisals came in at or above the (future) contract price. · But …

Why Most Purchase Appraisals SHOULD come in Just Above …

There is absolutely NO reason an appraiser should know the purchase price of the home – NONE AT ALL. In fact, some states, if not already, are trying to get a …

How long to close once appraisal is done?

So when the appraisal comes in, the lender should be more or less ready to go. It shouldn’t take longer than two weeks to close on your mortgage after the appraisal is done. It shouldn’t take longer than two weeks to close after the appraisal is done.

How does appraisal affect down payment?

While it’s always great for the property appraisal to come back higher than the amount you agreed to buy it for, this is no way affects the loan amount you need to qualify for, or the down payment you need to close on the mortgage loan.

Should you ever pay more than appraised value for a home?

Lenders want to ensure the homes they’re financing are worth the prices being paid, which is the major reason for property appraisals. Though there’s no law against paying more than a property’s appraised value, mortgage lenders almost never loan more than that value.

How often do appraisals come in lower than purchase price?

How often do home appraisals come in low? Low home appraisals do not occur often. According to Fannie Mae, appraisals come in low less than 8 percent of the time, and many of these low appraisals are renegotiated higher after an appeal, Graham says.

Do most homes appraise for selling price?

Does a house have to appraise for the selling price? No, but it should appraise for the loan amount. The financed price is the maximum amount a lender will loan relative to the home’s value (loan-to-value ratio). For example, if the LTV is 80%, it would require 20% down payment.

THT- What happens if the appraisal price is higher than contract price?

Images related to the topicTHT- What happens if the appraisal price is higher than contract price?

Can a seller raise the price after appraisal?

Can the seller back out if your appraisal is high? Realistically, the answer is “no.” For one, they accepted your offer and would be breaching the sales contract if they wanted to put the house back on the market to capture a higher price.

What happens if the house doesn’t appraise for the selling price?

Appraisal is lower than the offer: If the home appraises for less than the agreed-upon sale price, the lender won’t approve the loan. In this situation, buyers and sellers need to come to a mutually beneficial solution that will hold the deal together — more on that later.

What happens if a home appraisal is higher than the loan amount?

If A House Is Appraised Higher Than The Purchase Price

Your mortgage amount does not change because the selling price will not increase to meet the appraisal value.

Why do sellers not like VA loans?

Why don’t sellers like VA loans? Many sellers — and their real estate agents — don’t like VA loans because they believe these mortgages make it harder to close or more expensive for the seller.

How strict are VA appraisals?

VA appraisal guidelines can be strict and can eliminate fixer-uppers from contention. Many of the guidelines can be frustrating for military buyers who are considering older homes in need of renovation. If a home fails to meet the MPRs the buyer will have to decide how they want to proceed.

Do VA appraisals stick with the property?

The only time an appraisal report stays with a property is when it is financed with an FHA or VA loan. When this type of loan is used a case number is assigned to it, and the case number follows the property.

What does an appraiser look for in a VA loan?

VA appraisers will look at the property’s interior and exterior and assess the overall condition. They’ll also recommend any obvious repairs needed to make the home meet the MPRs. Remember, this isn’t a home inspection, and the VA doesn’t guarantee the home is free of defects.

Can VA loan waive appraisal?

While borrowers cannot waive VA appraisals the VA will consider requests to waive MPR repairs under three conditions. The request is signed by the Veteran borrower. The lender agrees with the Veteran’s request. The property is habitable from the standpoint of safety, structural soundness, and sanitation.

How does a VA loan affect the seller?

Using a VA loan means you’ll end up saving money both on the purchase and over the life of the loan. However, it does mean the person selling you the house will have to spend more to sell you the house. If you’re worried about the seller denying your offer because you’re using a VA loan, don’t be.

How do appraisers determine adjustments?

Adjustments are calculated by multiplying an adjustment factor times the quantity difference between the subject and comparable. For example, if the GLA for the subject is 2200 sq ft and for a comparable, 2000 sq ft, the difference, 200 sq ft would be multiplied by the adjustment factor.

\”The VA Appraisal is Terrible!!!\” Or is it??? Everything you need to know about VA Appraisals!

Images related to the topic\”The VA Appraisal is Terrible!!!\” Or is it??? Everything you need to know about VA Appraisals!

How do appraisers determine price per square foot?

Adjusting for Size

For instance, if a 3,500-square-foot house in a neighborhood sells for $500,000 while a similar but larger 3,700-square-foot house sells for $525,000, the appraiser can calculate a price per square foot for the market by dividing the two prices by the sizes of the two homes.

What do appraisers adjust for?

- Conditions of sale, like motivation.

- Property rights conveyed.

- Market conditions that affect the subject property.

- Financing terms.

- Location of the property.

- Physical characteristics of the land and improvements.

Related searches to Do VA appraisers know the contract price?

- do appraisers know the contract price

- why do appraisals come in at sales price reddit

- does appraiser know refinance amount

- why do appraisals come in at sales price

- do va appraisers know the selling price

- why do appraisals come in at sales price?

- do appraisers know loan amount reddit

- do appraisers know the contract price reddit

- appraisal exactly purchase price

- what does it mean when appraisal comes in at value

Information related to the topic Do VA appraisers know the contract price?

Here are the search results of the thread Do VA appraisers know the contract price? from Bing. You can read more if you want.

You have just come across an article on the topic Do VA appraisers know the contract price?. If you found this article useful, please share it. Thank you very much.