Table of Contents

Do you have to activate new bank card Halifax?

If you’re making online or phone purchases, you’ll be asked for your CVV number. This is the three or four-digit security code found on the back of your card.

Here’s the breakdown of why you don’t need to activate your Halifax debit card:

Debit cards are linked directly to your bank account. This means that when you use a debit card, the money is deducted directly from your account. There’s no need for a separate activation process because the card is already connected to your funds.

Credit cards, on the other hand, work differently. They offer you a line of credit, allowing you to make purchases and pay them back later. To ensure the safety of your credit line, credit cards require activation. This is a security measure to prevent unauthorized use of the card.

By activating your credit card, you’re essentially confirming that you’re the rightful owner of the card and that you’re ready to use it. This process helps prevent fraud and ensures that you have full control over your credit line.

How do I activate my new debit card?

Call your bank’s automated card activation system. Most banks have a dedicated phone number for this.

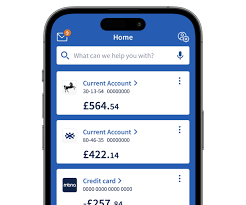

Use your bank’s website or mobile app. This is usually the fastest way to activate your card.

Visit your local bank branch. You can speak with a teller who can help you activate your card.

Once your card is activated, you can start using it right away! You can withdraw cash at an ATM or make purchases using your PIN.

But here’s the catch: You’ll need your existing debit card’s PIN to activate your new card. This is because your bank needs to verify your identity before activating a new card. So, make sure you have your old card handy when activating your new one.

Why is this a security measure?

It’s all about protecting your money! Banks want to ensure that only you can access your debit card and your funds. By using your existing debit card’s PIN, the bank can confirm that you are the rightful owner of the account. It’s like a digital handshake that says, “Hey, it’s really you!”.

A little tip: Don’t throw away your old debit card until you’ve successfully activated your new card. This way, you can still access your money if you run into any issues with the new card activation.

Can I use my Halifax Visa debit card abroad?

Fees Associated with Using Your Halifax Visa Debit Card Abroad

While using your Halifax Visa debit card abroad is generally convenient, you should be aware of the fees that might apply. These fees can vary depending on the type of transaction and the specific location.

Here are some of the fees you might encounter:

Foreign Transaction Fee: This is a percentage of the transaction amount charged by Halifax for using your card outside of Canada.

ATM Withdrawal Fee: Some ATMs may charge a fee for withdrawals, in addition to any fees charged by Halifax.

Currency Conversion Fee: When you make a purchase or withdraw cash in a currency other than Canadian dollars, you’ll likely be charged a currency conversion fee by Halifax. This fee is based on the current exchange rate and a markup applied by Halifax.

Tips for Minimizing Fees

To help minimize your fees when using your Halifax Visa debit card abroad:

Check with Halifax: Before you travel, contact Halifax to confirm the current fees associated with using your card abroad.

Use ATMs affiliated with your bank: If you need to withdraw cash, try to use ATMs that are affiliated with Halifax, as these might have lower fees.

Make large withdrawals: While it may be tempting to withdraw smaller amounts more frequently, it’s often more cost-effective to make fewer large withdrawals, as you’ll incur fewer ATM fees.

Pay in local currency: When making purchases, always ask to pay in the local currency, as this will typically result in a more favorable exchange rate.

By understanding the fees associated with using your Halifax Visa debit card abroad and taking steps to minimize them, you can make the most of your travels.

Can I use my new debit card straight away online?

Think of it like this: your debit card is like a key to your bank account. When you get the card, it’s like you’ve been given the key, and you can unlock your account to make online purchases. You can use it to shop at your favorite online stores, pay bills, or even transfer money between accounts. Just make sure you have your card details handy (card number, expiry date, and CVC code) when you’re making a purchase.

However, if you’re ever unsure about whether you can use your debit card for a specific transaction, it’s always best to check with your bank. They’ll be able to tell you exactly what your card is eligible for and any restrictions that might apply.

Can I use my new debit card without activating it?

Activating your debit card is quick and easy. Most banks have online or phone options. You’ll usually need to provide your card number, your personal information, and possibly a security code. Once you’ve activated your card, you can start using it to make purchases and withdraw cash.

Why is activation so important?

First, it’s like adding your name to the card. Without activation, the card is essentially blank and can be easily misused. Imagine someone finding your card and trying to use it. Activation prevents this by linking the card to your bank account.

Second, activation allows the bank to track your card activity. This helps them detect any suspicious activity and alert you in case of fraud.

Think of it this way: activation helps you control who can use your card and how. It’s a simple step that can give you peace of mind and keep your money safe.

What happens if new card is not activated?

Think of it this way: You’ve been given a key to a brand new car, but you haven’t started it yet. The car is ready to go, but you need to turn the key to make it move. The same goes for a credit card. You’ve been approved for the card, but you need to activate it to start using it.

The activation process is usually simple. You can often activate your card online, by phone, or through the mobile app. You might need your card number, Social Security number, and other personal information to verify your identity.

There are a couple of reasons why you might want to activate your credit card as soon as possible.

First, activating your card can help you start building your credit history. Credit history is an important factor in determining your credit score, which can affect your ability to get loans, mortgages, and other financial products.

Second, activating your card gives you access to the benefits and perks that come with the card. These benefits can include things like cash back rewards, travel miles, and purchase protection.

If you’re not ready to activate your card, that’s okay. You can always do it later. Just keep in mind that your account is still open and active, and you can start using it whenever you’re ready.

Can I activate my debit card online?

Some banks also allow you to activate your debit card via their mobile banking app. This can be even more convenient than using a computer. It’s always a good idea to check with your specific bank for their activation process. They may have specific requirements or timelines for activating your card.

While most banks allow you to activate your debit card online, it’s important to remember that some banks may require you to visit a branch in person to activate your card. This is typically the case if you need to provide additional documentation or if you have a specific account type. You can usually find this information on your bank’s website or by calling their customer service line.

Once you’ve activated your debit card, you can start using it right away. However, make sure to keep your card and PIN safe and secure. If you lose your card or suspect unauthorized activity, contact your bank immediately.

See more here: How Do I Activate My New Debit Card? | How Do I Activate My New Halifax Debit Card

Does Halifax have a 0% credit card activation code?

My Halifax card arrived quickly, but the online banking activation code was delayed. I was surprised because other banks typically send that code electronically. Halifax sends it by mail, which is a bit different, but it’s good to know that they’re taking extra security measures. Luckily, my 0% offer has a 90-day period, so I’m not worried about missing out on any benefits.

Here’s why Halifax sends a physical code:

The reason Halifax sends a physical activation code for online banking is to ensure the security of your account. It’s a common practice in the financial industry to use multi-factor authentication, which means using two or more methods to verify your identity before allowing access to your account. In this case, the first factor is your username and password, and the second factor is the physical code sent by mail.

This system helps protect you from fraud and unauthorized access, especially in a world where cybercrime is becoming increasingly sophisticated. Even though it takes a bit longer to set up online banking with Halifax, it’s worth it for the added security they offer.

Let’s talk about Halifax 0% credit card offers:

Many credit card companies offer 0% introductory periods, which are great for making large purchases, paying off existing debt, or managing your finances in a more flexible way. This is what you’re referring to when you say “0%.”

Important note: It’s crucial to remember that these 0% periods are temporary. When they end, you’ll start accruing interest at the card’s standard rate, which can be significant if you haven’t paid off the balance. Therefore, it’s important to set up a payment plan and make sure to pay off your balance before the 0% period ends, so you can avoid paying hefty interest charges.

Here’s the bottom line:

Halifax does not have a specific “0% credit card activation code,” as the activation code you received is for your online banking access, and it is completely separate from your 0% offer on your credit card.

Hope this helps! Let me know if you have any other questions.

How do I Activate my debit card?

Call your bank’s automated card activation system. This is usually the quickest and most convenient way to activate your card. You’ll find the number on the back of your card or on your bank’s website.

Use your bank’s website or mobile app. Many banks let you activate your debit card online. This is a great option if you’re already comfortable with online banking. Just log in to your account and follow the instructions.

Visit a bank branch. If you prefer in-person service, you can stop by your local bank branch and a teller can activate your card for you.

A couple of things to keep in mind:

Your bank may require you to provide your Social Security number or other personal information when you activate your card. This is just a security measure to verify your identity.

You’ll usually need to choose a PIN (Personal Identification Number) for your debit card. This PIN is used to authorize transactions at ATMs and point-of-sale terminals. Keep your PIN confidential and don’t share it with anyone.

Now, let’s talk about why it’s important to activate your debit card.

Think of it like turning on a light switch. Activating your card simply means you’re ready to use it. You need to activate it for your card to work.

Once your card is activated, you can start making purchases, withdrawing cash, and managing your money. It gives you the freedom and convenience of having your money readily available.

So, don’t delay, activate your card today and unlock all the benefits of using a debit card!

How do I report a lost or stolen Halifax credit card?

If you’re registered for Online Banking, you can report it and request a new card online or through the Halifax Mobile Banking app. It’s fast and easy. We’ll cancel your old card right away and send you a brand new one.

You can also temporarily freeze and unfreeze your card. This is a great option if you’ve misplaced your card and just need to make sure no unauthorized transactions happen.

Here’s what you need to know about reporting a lost or stolen Halifax credit card online:

Log in to your Online Banking account.

Navigate to the “Cards” or “Manage Cards” section.

Select the card you want to report.

Choose “Report Lost or Stolen” or a similar option.

Follow the on-screen instructions. You may be asked to provide some information to confirm your identity.

Once you’ve reported your card, we’ll cancel it and send you a new one. We’ll mail the replacement card to the address we have on file for you. It usually takes a few days to arrive.

Using the Halifax Mobile Banking app is just as easy:

Open the app and log in.

Go to the “Cards” or “Manage Cards” section.

Select the card you want to report.

Choose “Report Lost or Stolen” or a similar option.

Follow the on-screen instructions. You may be asked to provide some information to confirm your identity.

We’ll cancel your old card and send you a replacement. You’ll receive an email notification when your new card is shipped.

If you’re not registered for Online Banking or don’t have the app, you can report your lost or stolen card by phone. Just call Halifax customer service at [phone number] and they’ll help you.

Don’t forget to keep your new card safe! You can find some great tips on how to protect your cards from theft on the Halifax website.

How do I Activate my Visa card?

Let’s break it down a bit more:

Debit vs. Credit: When you use your card as debit, the funds are directly deducted from your linked bank account. When you use it as credit, you are essentially borrowing money from your credit card issuer. In this case, you want to use your card as debit to activate it.

PIN Number: Your PIN (Personal Identification Number) is a secret code that you chose when you received your Visa card. It’s important to keep this code safe and confidential to prevent unauthorized use of your card. If you have forgotten your PIN, you can usually call your card issuer to reset it.

Activation: Activating your Visa card is essentially telling your card issuer that you have received the card and are ready to use it. This is usually a simple process and, as we mentioned, can often be done with a simple debit purchase.

No Activation Fee: It’s worth noting that there is usually no fee associated with activating your Visa card. However, it’s always a good idea to check with your card issuer to confirm.

See more new information: musicbykatie.com

How Do I Activate My New Halifax Debit Card? A Step-By-Step Guide

The Basics

First things first, you’ll need your card details. You’ll find the card number printed on the front of your card, along with its expiry date and security code (CVV) printed on the back. Keep these handy.

Activation Methods

You have a couple of options for activating your Halifax debit card.

Online Activation: This is the most convenient method. Just head over to the Halifax website, and you’ll find the activation section. Follow the simple on-screen instructions.

Telephone Activation: If you’d prefer to talk to someone, give Halifax a call on their customer service number. You’ll need to provide your card details to activate it.

Step-by-Step Activation Guide

Let’s break down the activation process, step by step:

1. Gather Your Information: Make sure you have your card details: your card number, expiry date, and CVV.

2. Choose Your Activation Method: Decide whether you want to activate online or by phone.

3. Online Activation:

Visit the Halifax Website: Navigate to the Halifax website and find the activation section. You might need to log in to your online banking account.

Enter Your Card Details: Follow the on-screen instructions and provide your card details.

Confirm Activation: You might need to confirm your activation by entering a security code sent to your registered mobile number.

4. Telephone Activation:

Call Halifax Customer Service: Dial the Halifax customer service number.

Provide Your Card Details: The representative will guide you through the activation process. Be prepared to provide your card details.

Confirm Activation: The representative may ask you to confirm your activation by answering a security question or providing a PIN.

Important Notes

* Security: Always double-check that you’re on the official Halifax website before entering any personal information. Be wary of any suspicious links or requests for sensitive details.

Lost or Stolen Card: If your card has been lost or stolen, contact Halifax immediately to report it. They will deactivate the card and issue a replacement.

FAQs

1. How long does it take to activate my Halifax debit card?

The activation process is usually quick and straightforward. It can take a few minutes online or by phone.

2. Can I activate my debit card before I receive it?

No, you cannot activate your Halifax debit card before you receive it. You’ll need to have the card in hand to complete the activation process.

3. What if I forget my PIN?

Don’t worry! You can reset your PIN by calling Halifax customer service or by logging into your online banking account.

4. Can I use my Halifax debit card for international transactions?

Yes, you can use your Halifax debit card for international transactions. However, there may be some fees associated with these transactions. Check the Halifax website or contact customer service for details on international transaction fees.

5. What are the limits on my debit card?

Your debit card has daily transaction limits and withdrawal limits. These limits are set by Halifax. You can find information about your card limits by logging into your online banking account or by contacting Halifax customer service.

6. How do I make a payment with my Halifax debit card online?

To make a payment online, you’ll need to enter your card details: your card number, expiry date, and CVV. You may also be asked to enter your card’s security code. This is a three- or four-digit number usually found on the back of your card.

7. How do I keep my debit card safe?

Don’t share your PIN: Never share your PIN with anyone, even friends or family members.

Keep your card secure: Store your card in a safe place and always keep track of it.

Be cautious with online transactions: Only make purchases from reputable websites and always check for security measures, like SSL encryption.

That’s It!

And there you have it! Activating your Halifax debit card is a straightforward process, and you’ll be able to start using your card in no time.

Our Bank Account Debit Cards | Halifax

If you’re registered for Online Banking, you can report it and request a new card online or in the Halifax Mobile Banking app. We’ll cancel your card and send you a replacement. You can also freeze and unfreeze your card – handy if you’ve temporarily forgotten where Halifax

How To Activate Halifax Debit Card (Very Easy!) – YouTube

In this tutorial video, I will quickly guide you on how you can activate a Halifax debit card. So, make sure to watch this video till the end. If you have an… YouTube

Card & PIN services | Everyday banking | Halifax

You need to activate your new credit card before you start using it. You do not need to activate a new debit card. Halifax

How To Activate Halifax Debit Card (Very Easy!) – YouTube

Quick and Easy. 29.8K subscribers. Subscribed. 7. 1.2K views 3 months ago. In this video I will solve your doubts about how to activate halifax debit card, and YouTube

Halifax UK | Activate Your Credit Card | Credit Cards

Check the card details match your new credit card and then select Activate. All done – your card is now activated and ready to use. Open our secure online form. Halifax

How to Activate Your Debit Card on Halifax? Enable Your

Whether you’re a new account holder or just received a replacement card, this step-by-step tutorial will walk you through the hassle-free process of activating your YouTube

How to Activate a Visa Debit Card for Immediate Use:

Call your bank’s automated card activation system or use the website or mobile app to activate your debit card. You can also deposit or withdraw cash at an ATM or make a purchase with your new card WikiHow

4 Easy Ways to Activate Your ATM Card for the First

Whether you’re starting a new bank account or your old debit card just expired, it looks like it’s time to activate your new ATM card. This process is super simple—you can usually just activate your card at an WikiHow

How To Activate A New Bank Card | Card Help – HSBC UK

Activate your new card online, by phone or at a cash machine. Debit cards delivered after 30 November 2022 are ready to be used, so you won’t need to activate them. Just use HSBC UK

Halifax activation code for online banking – MoneySavingExpert

When you receive new debit card, you need to call them to activate it. Geez… something that can be done (at normal bank) with a single click in the app. At least MoneySavingExpert Forum

How To Activate Halifax Debit Card (Very Easy!)

How To Activate Halifax Debit Card (Very Easy!)

How To Activate Halifax Debit Card (2024)

How To Activate Halifax Bank Debit Card Online 2024?

How To Activate Halifax Mastercard Account 2023? Halifax Mastercard Activation

How To Activate Halifax Debit Card (2024) Easy Tutorial

How To Activate Halifax Debit Card

How To Activate Halifax Credit Card Account 2022? Halifax Credit Card Activation

Link to this article: how do i activate my new halifax debit card.

See more articles in the same category here: https://musicbykatie.com/wiki-how/