Are you looking for an answer to the topic “Do 457 contributions reduce AGI?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

Make pretax contributions to a

), 403(b), 457 or Thrift Savings Plan. You can contribute up to $18,000 in 2017, or $24,000 if you’re 50 or older, and the amount of the contribution is not included in AGI.457(b) contributions are deducted from your salary before federal, state and local income taxes are withheld (certain exceptions may apply). This means current tax savings are immediate, and reducing taxable income allows you to potentially save more for retirement.There are a number of ways to reduce your modified adjusted gross income to help you qualify to make Roth contributions: 1. Make pretax contributions to a 401(k), 403(b), 457 or Thrift Savings Plan.

Does 457 plan reduce taxable income?

457(b) contributions are deducted from your salary before federal, state and local income taxes are withheld (certain exceptions may apply). This means current tax savings are immediate, and reducing taxable income allows you to potentially save more for retirement.

Does 457 reduce AGI?

There are a number of ways to reduce your modified adjusted gross income to help you qualify to make Roth contributions: 1. Make pretax contributions to a 401(k), 403(b), 457 or Thrift Savings Plan.

How can I reduce my Adjusted Gross Income (\”AGI\”)?

Images related to the topicHow can I reduce my Adjusted Gross Income (\”AGI\”)?

What reduces your adjusted gross income?

Some deductions you may be eligible for to reduce your adjusted gross income include: Alimony. Educator expense deduction. Health savings account contributions.

Does adjusted gross income include deferred compensation?

The year of distribution of the deferred compensation is when the income is added to adjusted gross income often when income is lower, such as in retirement. There is no need to record the deferred compensation when it is contributed into the deferred account, only when it is distributed.

How do I claim 457 on my taxes?

Withdrawals from 457 retirement plans are taxed as ordinary income. However, distributions from a ROTH 457 plan are not subject to tax withholding. Also, 457 plan participants are permitted to roll over their funds into other qualified plans. Rollovers, except into a ROTH IRA, are not taxable events.

How do I report 457 on my taxes?

Employers report any distribution from a 457 plan on Form W-2, the annual Wage and Tax Statement that arrives each January for payments made in the previous year. The amount of the distribution appears in Box 11, “Nonqualified Plans.” The amount is also included in your gross wages that go in Box 1.

How can I reduce my adjusted gross income in 2020?

- Contribute to a Health Savings Account. …

- Bundle Medical Expenses. …

- Sell Assets to Capitalize on the Capital Loss Deduction. …

- Make Charitable Contributions. …

- Make Education Savings Plan Contributions for State-Level Deductions. …

- Prepay Your Mortgage Interest and/or Property Taxes.

See some more details on the topic Do 457 contributions reduce AGI? here:

7 Ways to Reduce Your Income to Qualify for Roth IRA …

1. Make pretax contributions to a 401(k), 403(b), 457 or Thrift Savings Plan · 2. Contribute to a health savings account · 3. Contribute to a …

Can IRAs Reduce Your Taxable Income? – Investopedia

Contributions to a traditional IRA can reduce your adjusted gross income (AGI), but Roth IRA contributions do not.

Contributions | Human Resources – Boston University

Your 457(b) Savings Plan contributions will be automatically deducted from your gross pay before any federal — and in most cases, state and local — income taxes …

A Guide to 457(b) Retirement Plans – SmartAsset

They do not come with early withdrawal penalties if you leave your job. So if you need to tap into your 457(b) contributions before you reach …

What’s modified adjusted gross income?

Modified Adjusted Gross Income (MAGI) in the simplest terms is your Adjusted Gross Income (AGI) plus a few items — like exempt or excluded income and certain deductions. The IRS uses your MAGI to determine your eligibility for certain deductions, credits and retirement plans. MAGI can vary depending on the tax benefit.

How do I reduce my modified adjusted gross income?

Reduce your MAGI with a retirement plan, HSA contributions, and self-employed health insurance premiums. You can reduce your MAGI by earning less money, but a lot of people prefer to look for deductions instead.

Does contributing to 401k reduce AGI?

Traditional 401(k) contributions effectively reduce both adjusted gross income (AGI) and modified adjusted gross income (MAGI). 1 Participants are able to defer a portion of their salaries and claim tax deductions for that year.

457 Retirement Plan | 457b Explained

Images related to the topic457 Retirement Plan | 457b Explained

Does standard deduction reduce AGI?

AGI is used to calculate your taxes in two ways:

It’s the starting point for calculating your taxable income—that is, the income you pay taxes on. To get taxable income, take your AGI and subtract either the standard deduction or itemized deductions and the qualified business income deduction, if applicable.

How can I reduce my taxable income after the end of the year?

- Contribute to retirement accounts. …

- Make a last-minute estimated tax payment. …

- Organize your records for tax time. …

- Find the right tax forms. …

- Itemize your tax deductions.

Does a 457 count as income?

457 plans are taxed as income similar to a 401(k) or 403(b) when distributions are taken. The only difference is there are no withdraw penalties and that they are the only plans without early withdrawal penalties.

How do I calculate my adjusted gross income?

The AGI calculation is relatively straightforward. Using the income tax calculator, simply add all forms of income together, and subtract any tax deductions from that amount. Depending on your tax situation, your AGI can even be zero or negative.

How is adjusted gross income calculated?

The AGI calculation is relatively straightforward. It is equal to the total income you report that’s subject to income tax—such as earnings from your job, self-employment, dividends and interest from a bank account—minus specific deductions, or “adjustments” that you’re eligible to take.

Is deferred compensation considered earned income?

Is deferred compensation considered earned income? Deferred compensation is typically not considered earned, taxable income until you receive the deferred payment in a future tax year. The use of Roth 401(k)s as deferred compensation, for example, is an exception, requiring you to pay taxes on income when it is earned.

Are deferred compensation contributions tax deductible?

Qualified Deferred Compensation Rules

The deferred compensation still counts as wages for the purpose of calculating payroll taxes. You can deduct your employer contribution to the employee accounts when you make it — a rare exception to the general rule that your deduction match up to your employee reporting income.

How do I avoid taxes on deferred compensation?

If your deferred compensation comes as a lump sum, one way to mitigate the tax impact is to “bunch” other tax deductions in the year you receive the money. “Taxpayers often have some flexibility on when they can pay certain deductible expenses, such as charitable contributions or real estate taxes,” Walters says.

How can I reduce my AGI 2022?

- Enroll in an employee stock purchasing program. If you work for a publicly traded company, you may be eligible to enroll in an Employee Stock Purchase Plan (ESPP). …

- Contribute to a 401(k) or traditional IRA.

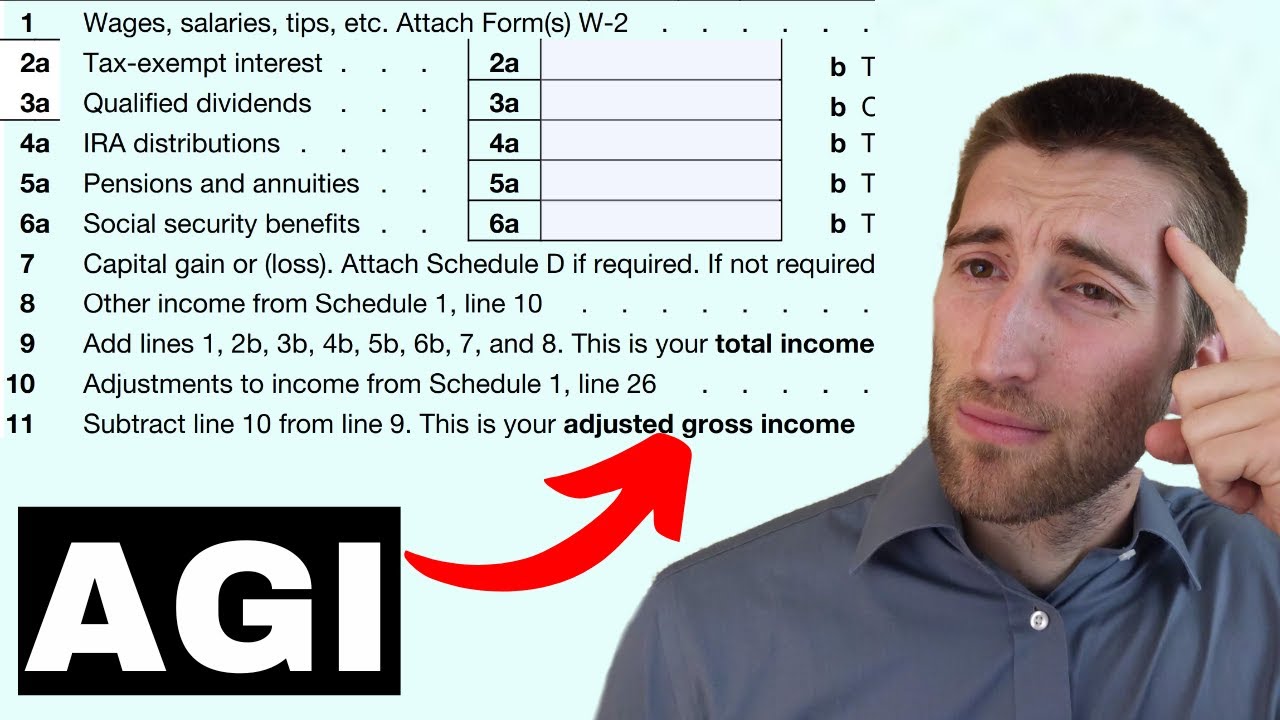

Adjusted Gross Income Explained (For Anyone To Understand!)

Images related to the topicAdjusted Gross Income Explained (For Anyone To Understand!)

Do health insurance premiums reduce AGI?

If you are self-employed, you can deduct the amount you paid for health insurance and qualified long-term care insurance premiums directly from your income. This reduces your adjusted gross income (AGI), which lowers your tax bill.

Does an IRA contribution reduce AGI?

Contributions to a traditional IRA can reduce your adjusted gross income (AGI) for that year by a dollar-for-dollar amount. If you have a traditional IRA, your income and any workplace retirement plan you own may limit the amount by which your AGI can be reduced.

Related searches to Do 457 contributions reduce AGI?

- do ira contributions reduce magi

- do ira contributions reduce agi

- do 401k contributions reduce agi

- how to lower agi after year end

- do tsp contributions reduce agi

- how to reduce agi

- do retirement contributions reduce agi

- do pension contributions reduce agi

- does 457 reduce taxable income

- do contributions to 401k reduce agi

- do 457 contributions reduce magi

- does 457 b reduce agi

- do 457 contributions reduce agi

- do 403b contributions reduce agi

Information related to the topic Do 457 contributions reduce AGI?

Here are the search results of the thread Do 457 contributions reduce AGI? from Bing. You can read more if you want.

You have just come across an article on the topic Do 457 contributions reduce AGI?. If you found this article useful, please share it. Thank you very much.