Are you looking for an answer to the topic “Do Premium Bonds go on tax return?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

Taxable securities — For most investors, any premium paid on a taxable bond can be partially recovered through your income tax filing, if the bond is held to maturity. The premium on a taxable bond can be either amortized over the remaining life of the bond or taken as a capital loss at maturity.Tax and you do not need to declare it on your tax return. Anybody over the age of 16 can buy Premium Bonds, and you can also buy them on behalf of your child or grandchild.Yet money made from Premium Bonds, like cash ISAs, is always tax-free and does not count towards the PSA, so it’s almost like an extra allowance.

Table of Contents

Do you have to declare premium bonds?

Tax and you do not need to declare it on your tax return. Anybody over the age of 16 can buy Premium Bonds, and you can also buy them on behalf of your child or grandchild.

Do premium bonds count as income?

Yet money made from Premium Bonds, like cash ISAs, is always tax-free and does not count towards the PSA, so it’s almost like an extra allowance.

Premium Bond prize rate increase to 1.4%: Will you win more?

Images related to the topicPremium Bond prize rate increase to 1.4%: Will you win more?

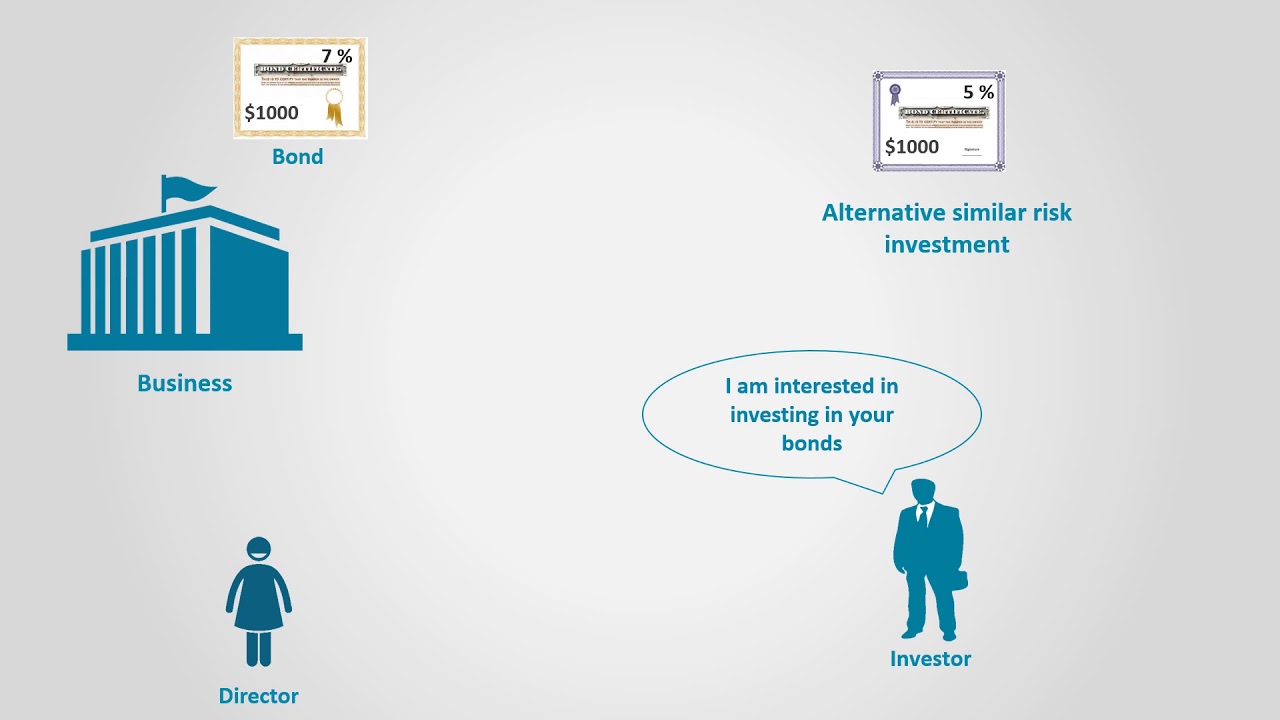

How is bond premium handled on tax return?

If the bond is a tax-exempt municipal, you report the loss of premium value and subtract the loss from the cost basis of the bond, but you don’t subtract it from your taxable income. Tax-exempt bonds purchased for a price above par must be amortized.

Do premium bonds count as assets?

Premium Bonds are an asset that forms a part of someone’s estate, just like a bank account or a savings account. Unlike bank accounts, all Premium Bonds are held with the government under the National Savings and Investments (NS&I) agency.

Do you need to declare Premium Bonds on self assessment?

ISAs, National Savings, Premium Bonds and prize winnings do not need to be declared.

Do you pay tax on NS&I Premium Bonds?

Our Premium Bonds give you the chance to win cash prizes from £25 up to £1 million in our monthly prize draw. If you’re a lucky winner, you won’t have to pay a penny in tax on your prize. If you already hold some of our Savings Certificates, you won’t have to pay tax on any returns you earn.

Do I have to declare savings interest to HMRC?

If you complete a Self Assessment tax return, report any interest earned on savings there. You need to register for Self Assessment if your income from savings and investments is over £10,000. Check if you need to send a tax return if you’re not sure.

See some more details on the topic Do Premium Bonds go on tax return? here:

National Savings and Investments products | nidirect

Tax and you do not need to declare it on your tax return. Anybody over the age of 16 can buy Premium Bonds, and you can also …

Do you have to declare your Bonds on your tax return? Check …

Premium Bonds do not count towards one’s personal allowance, and essentially creates its own allowance if one were to win a big payout. All …

Tax Considerations for I Bonds – TreasuryDirect

The 1099-INT will show all the interest the bond has earned over the years. Go to IRS Publication 550, …

Premium Bonds: are they worth buying? – MoneySavingExpert

Premium Bond prizes (the interest) are paid tax-free. However, for most people that’s no longer a bonus. Since 2016, the personal savings …

Do you pay tax on bonds UK?

As there’s no UK tax on income and gains within the bond, there’s no credit available to the bond holder. Gains are taxed 20%, 40% or 45%. Gains will be tax free if they’re covered by an available allowance: personal allowance (2022/23 – £12,570)

Do I pay tax on savings bonds?

If you hold savings bonds and redeem them with interest earned, that interest is subject to federal income tax and federal gift taxes. You won’t pay state or local income tax on interest earnings but you may pay state or inheritance taxes if those apply where you live.

Where does bond interest go on tax return?

- Taxable interest goes on Schedule B of Form 1040. …

- Tax-exempt municipal bond interest is reported on Line 2a of Form 1040. …

- Private activity bond interest is reported on Line 2g of Form 6251 as an adjustment for calculating the alternative minimum tax.

Bonds Premium and Discounts (Financial Accounting)

Images related to the topicBonds Premium and Discounts (Financial Accounting)

How do I report savings bond interest on tax return?

- Report the interest in the year you earn it.

- Report the entire amount of interest earned when the bond matures or when you redeem it, whichever comes first.

Where does bond premium on tax-exempt bonds go on the tax return?

See Pub. 550 for more information about OID, bond premium, and acquisition premium. Also include on line 2a of your Form 1040 or 1040-SR any exempt-interest dividends from a mutual fund or other regulated investment company. This amount should be shown in box 11 of Form 1099-DIV.

Is there a downside to premium bonds?

Disadvantage: Initial delays:

Bonds purchased are entered into their first prize draw after they have been held for a full prize cycle. That means that Bonds bought during March will be held back until the May prize draw. That means that, borrowing from your Premium Bonds could mean that you miss a winning month.

Do premium bonds count as savings for universal credit?

Savings are counted as any money you can get hold of relatively easily, or financial products that can be sold on. These include: cash and money in bank or building society accounts, including current accounts that don’t pay interest. National Savings and Investments savings account and Premium Bonds.

What happens if you inherit premium bonds?

The customer who has died has won a Premium Bond prize and been sent a prize warrant – what should I do? Please send the prize warrant back to us and we’ll reissue it to the person entitled to the money, once we’ve completed the claim.

How can I hide my savings from benefits UK?

…

- Property (not your main residence)

- Joint savings.

- Income bonds.

- Premium bonds.

- Stocks and shares.

What savings are tax-free?

The starting rate for savings if you’re on a low income

This means that up to £5,000 of the interest received from savings is tax-free. You can earn up to £17,570 a year in 2022-23 (as long as your personal allowance is the standard £12,570) and usually still be eligible for the starting rate for savings.

Are NS&I savings certificates taxable?

Index-linked Savings Certificates are still a popular investment with a unique combination of index-linking plus a small amount of additional interest – all tax-free.

Can HMRC check your bank account?

Currently, the answer to the question is a qualified ‘yes’. If HMRC is investigating a taxpayer, it has the power to issue a ‘third party notice’ to request information from banks and other financial institutions. It can also issue these notices to a taxpayer’s lawyers, accountants and estate agents.

Premium Bond Prize Rate Rise

Images related to the topicPremium Bond Prize Rate Rise

How can I avoid paying taxes on savings bonds?

- The I bonds must have been purchased after 1989.

- You must pay for the qualified education expenses in the same tax year you cash in your Series I savings bonds.

- You must be at least 24 years old on the first day of the month in which you bought the bonds.

How much money can you have in your bank account without being taxed UK?

Every basic rate taxpayer in the UK currently has a Personal Savings Allowance (PSA) of £1,000. This means that the first £1,000 of savings interest earned in a year is tax-free and you only have to pay tax on savings interest above this.

Related searches to Do Premium Bonds go on tax return?

- where do you enter bond premium on my tax return

- national savings bonds

- how do i cash in my national savings certificate

- how do you report bond premium on tax return

- national savings premium bonds

- do you declare premium bonds on tax return

- how does bond premium affect tax return

- national savings certificates old

- martin lewis premium bonds

- do premium bonds go on tax return

- where does bond premium on tax exempt bonds go on the tax return

- national savings and investments

- best time to buy premium bonds

- who issues 1099 int for savings bonds

- where does bond premium go on tax return

- where does bond premium on tax-exempt bonds go on the tax return

Information related to the topic Do Premium Bonds go on tax return?

Here are the search results of the thread Do Premium Bonds go on tax return? from Bing. You can read more if you want.

You have just come across an article on the topic Do Premium Bonds go on tax return?. If you found this article useful, please share it. Thank you very much.