Are you looking for an answer to the topic “Do Employers Partially Fund 401k Accounts By Using A Portion Of Wages Before Tax?“? We answer all your questions at the website Musicbykatie.com in category: Digital Marketing Blogs You Need To Bookmark. You will find the answer right below.

Keep Reading

Table of Contents

Are employer contributions to 401k pre-tax or post tax?

In addition to potentially offering free money through a match, employer-sponsored retirement plans can give you significant tax advantages. Contributions to tax-advantaged retirement accounts, such as a 401(k), are made with pre-tax dollars. That means the money goes into your retirement account before it gets taxed.

How is employer 401k contribution calculated?

For example, let’s assume your employer provides a 50% match on the first 6% of your annual salary that you contribute to your 401(k). If you have an annual salary of $100,000 and contribute 6%, your contribution will be $6,000 and your employer’s 50% match will be $3,000 ($6,000 x 50%), for a total of $9,000.

401k and Retirement Funds | Employer Investment Accounts (According to Study.com)

Images related to the topic401k and Retirement Funds | Employer Investment Accounts (According to Study.com)

How are employer contributions to 401k taxed?

Is a 401(k) match taxable? Employer contributions are always taxed when withdrawn. This is because employer matching contributions are always made on a pre-tax basis. This is true whether the employee is deferring on a pre-tax or Roth contribution basis.

How does 401k work with payroll?

A 401(k) plan is a defined-contribution plan, meaning employees contribute a portion of their wages—either a specified dollar amount or percentage of a paycheck—to their account. While processing employee contributions may seem straightforward, there’s data moving from multiple systems.

Is it better to contribute pre-tax or after-tax?

You may save by lowering your taxable income now and paying taxes on your savings after you retire. You’d rather save for retirement with a smaller hit to your take-home pay. You pay less in taxes now when you make pretax contributions, while Roth contributions lower your paycheck even more after taxes are paid.

Is 401k taken from gross or net?

You fund 401(k)s (and other types of defined contribution plans) with “pretax” dollars, meaning your contributions are taken from your paycheck before taxes are deducted. That means that if you fund a 401(k), you lower the amount of income you have to pay taxes on, which can soften the blow to your take-home pay.

How much should I contribute to my 401k based on salary?

Most retirement experts recommend you contribute 10% to 15% of your income toward your 401(k) each year. The most you can contribute in 2021 is $19,500 or $26,000 if you are 50 or older. In 2022, the maximum contribution limit for individuals is $20,500 or $27,000 if you are 50 or older.

See some more details on the topic Do Employers Partially Fund 401k Accounts By Using A Portion Of Wages Before Tax? here:

Do employers partially fund 401k accounts by using a portion of …

Do employers partially fund 401k accounts by using a portion of wages before tax? The correct answer here then is: True. This savings is created from the …

What is a 401(k) Plan & How Does it Work? | Paychex

Many 401(k) plans are administered through a sponsoring employer, allowing employees to contribute funds to their plans on a pre-tax basis.

401(k) Plans – The Balance

A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their pre-tax earnings. Some employers match employee …

What Is An Employer’s 401(k) Match? – Forbes Advisor

Remember, with a traditional 401(k) account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth …

Is 401k match based on salary?

The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute … but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%.

Are 401k catch-up contributions pre-tax?

Roth 401(k) Catch-Up Contributions

“Unlike a regular 401(k) contribution, contributions to a Roth 401(k) are not made on a pretax basis, so the employee pays tax on $6,500 first, then contributes the extra $6,500 into the 401(k),” Falcon says.

Are 401k contributions pre-tax?

Your 401(k) contributions are made pre-tax—your employer won’t include these contributions in your taxable income.

What is the safe harbor rule for 401k?

A safe harbor 401(k) plan provides all eligible plan participants with an employer contribution. In exchange, safe harbor plans allow businesses to avoid annual IRS nondiscrimination testing. Any 401(k) plan can be designed to include a safe harbor contribution. Read if it’s right for you.

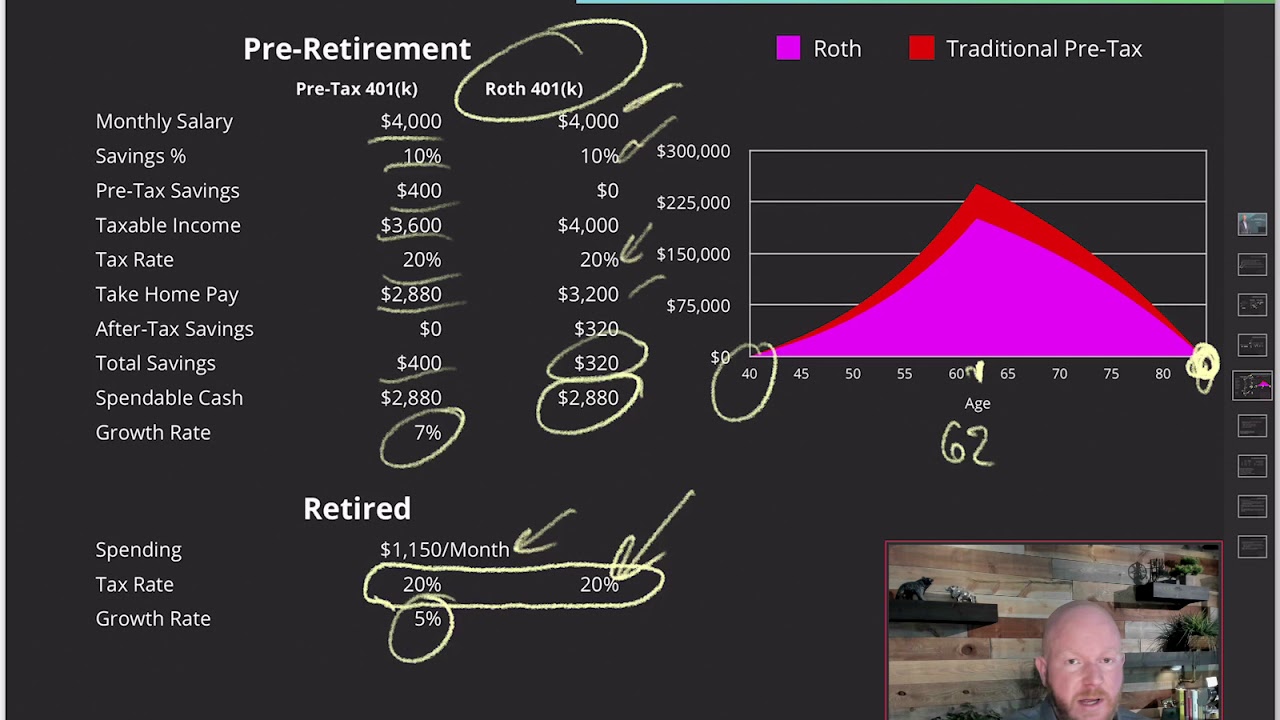

Is It Better To Do A Pre-tax or Roth 401K?

Images related to the topicIs It Better To Do A Pre-tax or Roth 401K?

How does a 401k work for dummies?

A 401(k) is a retirement savings and investing plan that employers offer. A 401(k) plan gives employees a tax break on money they contribute. Contributions are automatically withdrawn from employee paychecks and invested in funds of the employee’s choosing (from a list of available offerings).

Does w2 wages include 401k?

401(k) contributions are recorded in box 12 of the W-2 tax form, under the letter code “D”.

What are two examples of employer contributions?

- 401(k) Plan. This is the most common type of employer-sponsored retirement plan. …

- Roth 401(k) Plan. This type of plan offers the same benefits as a traditional Roth IRA with the same employee contribution limits as a traditional 401(k) plan. …

- 403(b) Plan. …

- SIMPLE Plan.

Should I contribute to my 401k pre-tax or Roth?

If you plan on more income or higher taxes in retirement, tax-free withdrawals from Roth contributions may make sense, and tax-deferred contributions may be better if you expect lower earnings and levies.

Is it better to do Roth or pre-tax 401k?

The biggest benefit of the Roth 401(k) is this: Because you already paid taxes on your contributions, the withdrawals you make in retirement are tax-free. That’s right! The money you put in—and its growth!

Why is a Roth IRA better than a 401k?

A Roth 401(k) has higher contribution limits and allows employers to make matching contributions. A Roth IRA allows your investments to grow for a longer period, offers more investment options, and makes early withdrawals easier.

Does adjusted gross income include 401k contributions?

Most tax deductions are based on either your adjusted gross income or your modified AGI. Your 401(k) contributions are deducted from your pay before taxes, so they are not included in your modified AGI.

What percentage of paycheck goes to 401k?

For that reason, many experts recommend investing 10-15 percent of your annual salary in a retirement savings vehicle like a 401(k). Of course, when you’re just starting out and trying to establish a financial cushion and pay off student loans, that’s a pretty big chunk of cash to sock away.

What percentage should I contribute to my 401k at age 40?

Save Early And Often In Your 401k By 40

After you have contributed a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

401k Company Matching Explained

Images related to the topic401k Company Matching Explained

What percentage should I contribute to my 401k at age 30?

If you started investing at 20: You’d need to invest $316.25 per month, or 7.6% of your salary. If you started investing at 30: You’d need to invest $884.76 per month, or 21.2% of your salary. If you started investing at 40: You’d need to invest $2,633.76 per month, or 63.2% of your salary.

What is the average 401k balance for a 35 year old?

| AGE | AVERAGE 401K BALANCE | MEDIAN 401K BALANCE |

|---|---|---|

| <25 | $6,718 | $2,240 |

| 25-34 | $33,272 | $13,265 |

| 35-44 | $86,582 | $32,664 |

| 45-54 | $161,079 | $56,722 |

Related searches to Do Employers Partially Fund 401k Accounts By Using A Portion Of Wages Before Tax?

- 401k number

- 401k accounts are what type of accounts?

- is an ira the same as a 401k

- what is true about credit unions?

- 401k accounts are what type of accounts

- what is true about credit unions

- average return on 401k

- does 401k count as income

- what is the main purpose of government regulations of financial institutions

Information related to the topic Do Employers Partially Fund 401k Accounts By Using A Portion Of Wages Before Tax?

Here are the search results of the thread Do Employers Partially Fund 401k Accounts By Using A Portion Of Wages Before Tax? from Bing. You can read more if you want.

You have just come across an article on the topic Do Employers Partially Fund 401k Accounts By Using A Portion Of Wages Before Tax?. If you found this article useful, please share it. Thank you very much.